Few people in the investing community are respected and admired like Charlie Munger. Business Partner of Warren Buffet for more than five decades, Munger is the guy you cannot afford to ignore if you are a serious investor.

Just 34 days short of completing his 100th year, he died on the morning of 28th November 2023, peacefully, at a California hospital. Warren Buffett, in the official press release of Berkshire Hathaway, said: “Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation.

Charlie was one of the world’s greatest investing minds and one of the few great people in the world who dared to speak his mind in public. He did not care to please anyone including politicians.

Lifelong learning, intellectual curiosity, sobriety, avoidance of envy and resentment, reliability, learning from the mistakes of others, perseverance, objectivity, and willingness to test one’s own beliefs were some values Charlie lived by and professed.

At one annual meet, Charlie said: “We like the stocks of both Berkshire and Wesco to trade within hailing distance of what we think of as intrinsic value. When it runs up, we try to talk it down. That’s not at all common in Corporate America, but that’s the way we act.”

Munger’s quote, “I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines,” highlights his belief in the transformative power of continuous learning.

Early Life and Education

Charles Thomas Munger was born on January 1, 1924, in Omaha, Nebraska. His early life and education laid the foundation for his exceptional intellect, analytical prowess, and unwavering commitment to value investing principles.

Munger’s formal education began at the University of Michigan, where he initially pursued mathematics but left to serve in the U.S. Army Air Corps during World War II. Upon returning to civilian life, he enrolled at the California Institute of Technology, studying physics and meteorology. However, his true calling lay in the realm of law, leading him to Harvard Law School, where he graduated magna cum laude in 1948.

During his time at Harvard, Munger developed a deep appreciation for the power of logic, critical thinking, and the importance of understanding human behaviour – all of which would prove instrumental in his investment decisions throughout his career. He also embraced a multidisciplinary approach to knowledge, drawing insights from psychology, economics, history, and philosophy.

Working as a Lawyer

After graduating from Harvard Law School in 1948, he joined the prestigious law firm Munger, Tolles & Olson, which he co-founded in 1962. He became a renowned attorney in corporate and real estate law, known for his sharp intellect, analytical skills, and strong negotiation abilities. The firm he co-founded over half a century ago is still in business and has built a great reputation in the legal domain.

Munger’s legal career was instrumental in shaping his investment philosophy. He gained valuable insights into business operations, corporate law, and the importance of sound financial analysis. His legal experience also taught him the importance of understanding human behaviour, which proved crucial in navigating the complexities of the investment world.

From Lawyering to Investing

Charlie Munger’s transition from law to business was a gradual process driven by his growing interest in investing and his entrepreneurial spirit. While he enjoyed his legal career and was successful in it, he found himself increasingly drawn to the world of business and finance.

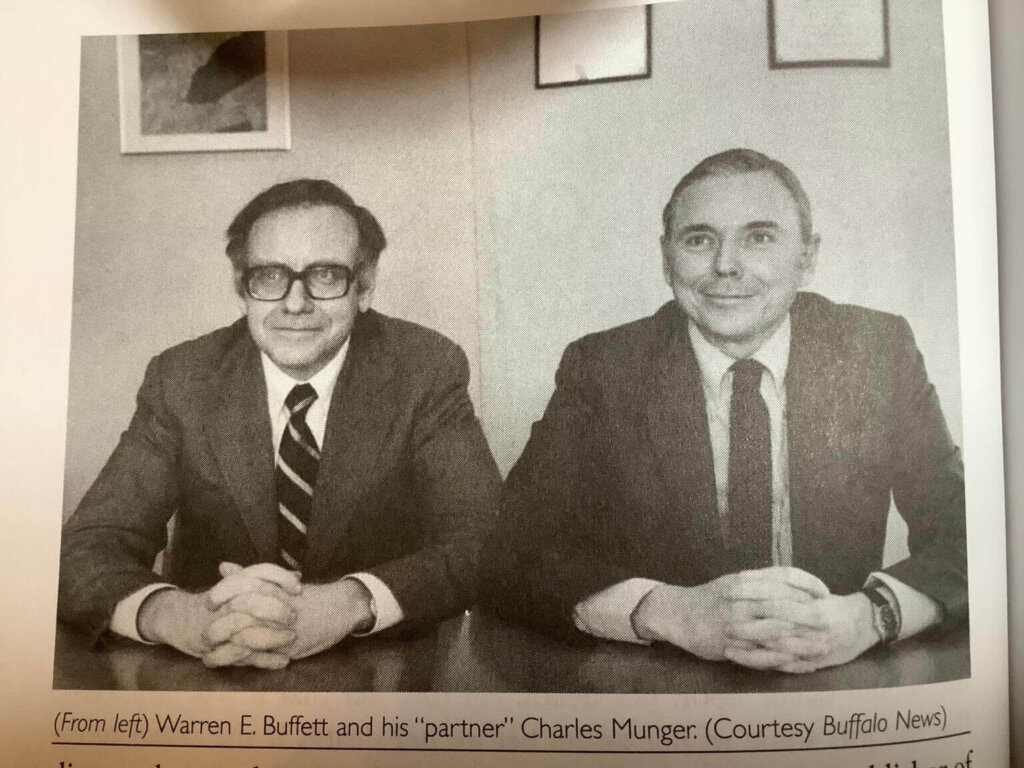

Charlie Munger and Warren Buffett first met in 1959 at a dinner party in their hometown of Omaha, Nebraska. Both men quickly recognized a shared passion for value investing and a similar approach to business. Their initial meeting sparked a lifelong friendship and a highly successful partnership at Berkshire Hathaway.

Munger’s friendship with Warren Buffett played a significant role in his transition to business. Buffett’s success and mentorship inspired Munger to pursue his passion for investing and apply his skills to building a successful business career. The duo have been the most admired partners in the business and investing world.

In 1968, Munger shifted his focus from law to investment management, establishing Wheeler, Munger & Co., a hedge fund that achieved impressive returns for its investors. He also became a vice chairman of Berkshire Hathaway and a close confidante of Warren Buffett, influencing the company’s investment strategy and contributing to its remarkable growth over the years.

It’s Better to buy a Wonderful Company at a fair price

Wise men have said that quality is remembered long after price is forgotten. Munger seems to have understood this concept quite well and extended its application to his investment decisions. There is no doubt that Buffett was an astute investor before he had ever heard of Charlie, but Charlie Munger helped him understand the importance of high quality.

One of the most popular lessons Munger taught us is this: It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

This is, to be honest, easier said than done. Even Buffett seemed to have some trouble grasping this at first. It seems very hard to pay more price for a high-quality product that might last a lifetime than to buy a cheaper replica at a quarter of the price of the original that may only last six months.

Coca-Cola and See’s Candy are some such high-quality businesses that have reaped huge rewards for Berkshire Hathaway. Although they were not crazy bargains, they were extremely high-quality businesses with great competitive advantages.

Responding to someone when asked about his role in the success of Warren Buffett, he said:

“I think there’s some mythology in the idea that I’ve been this great enlightener of Warren. He hasn’t needed much enlightenment. I frankly think I got more credit than I deserve. It is true that Warren had a touch of brain block from working under Ben Graham and making it ton of money. It’s hard to switch from something that’s worked so well. But if Charlie Munger had never lived, the Buffett record would still be pretty much what it is.”

The brain block Munger mentioned refers to Buffett’s earlier style of preferring value over other parameters, something he had learned from his professor Ben Graham. Charlie Munger convinced Warren to look for quality at a reasonable price. In the long run, this strategy has worked wonders for them.

Anyways, due to huge competition in the marketplace among investors, the no-brainer deals that existed in the era of Benjamin Graham and Warren Buffett have almost disappeared.

20 wonderful Insights from Charlie Munger

“The wisdom of the wise, and the experience of ages, may be preserved by quotations.”

Isaac Disraeli

Charlie Munger was one hell of a guy. He believed in good old values of hard work and integrity which are lacking in today’s world. Not only he was a great human being, but he was also a great teacher. Here are some of Charlie Munger’s quotes that I hope will act as a guiding light to those who learn from them:

- “I think a life properly lived is just learn, learn, learn all the time.”

- “You should never, when faced with one unbelievable tragedy, let one tragedy increase into two or three because of a failure of will”.

- “Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Systematically you get ahead, but not necessarily in fast spurts. Nevertheless, you build discipline by preparing for fast spurts. Slug it out one inch at a time, day by day. At the end of the day – if you live long enough – most people get what they deserve.”

- “Take a simple idea, and take it seriously.”

- “I didn’t get to where I am by going after mediocre opportunities.”

- “I see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help.”

- “I want to think about things where I have an advantage over others. I don’t want to play a game where people have an advantage over me. I don’t play in a game where other people are wise and I am stupid. I look for a game where I am wise, and they are stupid. And believe me, it works better. God bless our stupid competitors. They make us rich.”

- “I am not smart enough to make decisions with no time to think. I make actual decisions very rapidly, but that’s because I have spent so much time preparing ourselves by quietly reading.”

- “Avoid crazy at all costs.”

- “The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.”

- “The man who does not read good books has no advantage over the man who can’t read them.”

- “It isn’t the learning that’s so hard. It’s the unlearning.”

- “The decision to do x is the decision not to do y. Investing $1,000 in Apple is the decision not to invest that $1,000 in Microsoft. Investing is all about finding the best place to put your money.”

- “Brokers are incentivized to get you to buy and sell stocks. Managers are incentivized to make you think they run a good company. Always consider the incentives that drive people.”

- “The stock investor is neither right nor wrong because others agreed or disagreed with him.”

- “In investing you aren’t rewarded just for making more complex investments. The simplest way to invest would be to dollar cost average into an index fund and that beats 90% of actively managed funds.”

- “In investing you don’t need to buy every company. Instead, wait for the right opportunity to come along.”

- “Happiness is the result of the actual outcome vs the expected outcome. If you expect every stock to double within a year you will be disappointed.”

- “If you doubled a penny every day for 30 days, the amount on day 30 would be $5,368,709.12.”

- “It isn’t the learning that’s so hard. It’s the unlearning.”

If you listen to Charlie’s advice, which is mostly to avoid the most common mistakes out there, you might not be very intrigued. If you read more about Munger, which you should do whether or not you want to be an investor, you will realize how different the path to success for him was than one might expect.

Munger often emphasized the importance of identifying your strengths and not competing in games where you did not have an advantage over your opponents. So if you know that you are not better than your opponents and may not become better than them, better find another game.

This might seem very unconventional but you do not do great by doing what everyone else is doing. Finally, it is as true in investing as it is in life, patience is what helps you reach places few have been. And to have patience, to stick to something long enough, you must love what you do and you must have conviction in your ideas.

There is a lot more to learn from the life of the legend the world just lost. I hope his life and teachings continue to light the path of all who seek. Poor Charlie’s Almanack is a great book if you want to know more about Charlie.

I would love to read your thoughts and the lessons that you learnt from Charlie in the comments. Stay Curious!