Born on 30th September 1930, the best-known stock market investor of all time, popularly known as the “Oracle of Omaha”, Warren Buffett turned 92 this year. Arguably the most admired guy in the investing world, Buffett is also a great business tycoon and a philanthropist. Here are 5 facts about the legend you probably didn’t know.

1. Harvard Business School rejected Warren Buffett

Although it is hard to believe, Harvard Business School rejected Buffett, where he applied after completing graduation from the University of Nebraska. He remembers having been told by the screening committee, “Forget it. You’re not going to Harvard.”

Although he got a little disappointed at the time, Warren Buffett now thinks that it was the best thing that ever happened to him. After the rejection, Buffett applied to Columbia Business School where two professors who he greatly admired, accepted him. These two were none other than the legendary Benjamin Graham (the father of Value Investing) and David Dodd (co-author of the book Security Analysis with Ben Graham).

Looks like all rejections are not always bad, after all.

2. Buffett lives in the same house he bought in 1958.

They say Wealth is all about what you don’t see. Looking at his modest house, nobody can tell that inside it lives one of the richest men in the world. Warren Buffett purchased the house for $31,500 back in 1958, which is roughly $300,000 in today’s time.

For someone with a net worth of $104 Billion, seems pretty modest, doesn’t it?

3. Warren Buffett drives a…

When it comes to Billionaires, one automatically starts to think about expensive cars like the Bugattis, Rolls Royce, etc. But I am afraid Warren Buffett is going to disappoint you guys with his Cadillac XTS worth about $45,000. Although a great sports sedan with a powerful V-6 engine, the Cadillac XTS does not come anywhere near the power or the luxury offered by the BMWs, and Rolls Royce.

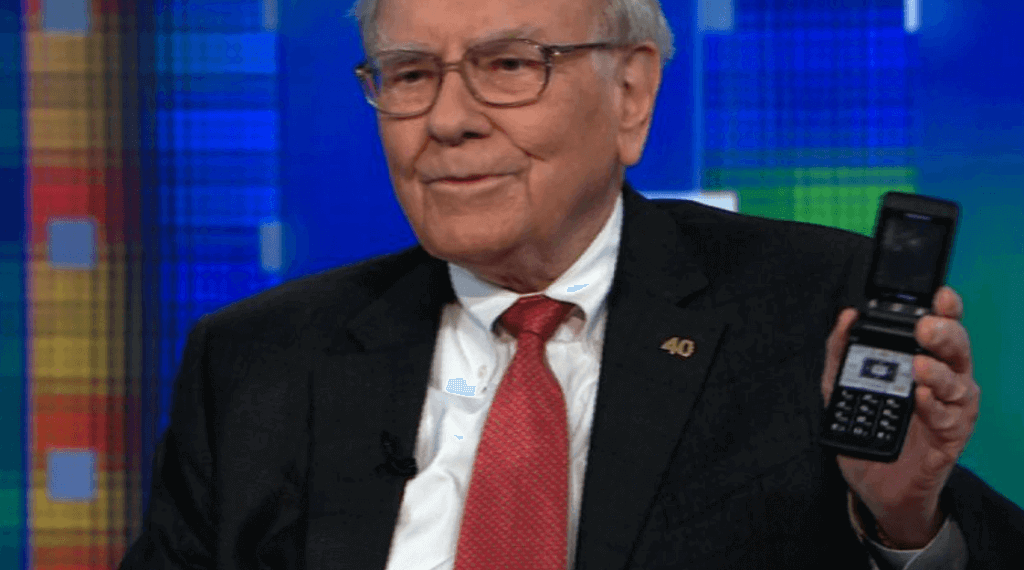

4. The mobile phone Warren Buffett uses is

Although Warren Buffett can still beat almost all of the tech-savvy investors out there, he himself is not a big fan of modern gadgets such as smartphones. Until very recently, Buffett kept using his Samsung flip phone which he pulled out from his pocket and showed Piers Morgan in a 2013 CNN interview. He jokingly said, “This is the one Alexander Graham Bell gave me”. He then added, “I don’t throw anything away until I’ve had it 20 or 25 years.”

However, in 2020, he finally got a new iPhone 11 which was gifted to him by none other than the Apple CEO, Tim Cook. Cook even assured Warren that he’d fly to Omaha to provide tech support for his new Apple device.

Warren has pledged to donate 99% of his wealth. In his pledge letter, he wrote, “Too often, a vast collection of possessions ends up possessing its owner. The asset I most value, aside from health, is interesting, diverse, and long-standing friends.” Clearly, the billionaire investor is not a very materialistic person and values relationships over stuff.

5. Warren Buffett is a fan of Breaking Bad

It may come as a surprise to many but it’s true. Warren Buffett’s love for Breaking Bad came to light when he shared the below tweet in 2013, one of his only 7 tweets on his account.

Not even the Oracle knows what will happen tonight. #waltsuccessor pic.twitter.com/EM8gIzZib5

— Warren Buffett (@WarrenBuffett) September 30, 2013

Buffett fans may want more facts but that’s all we got for y’all folks today. Let me know in the comments if you liked this post and would like more posts like this. Cheers!

Nice Article.