When we Indians think about insurance, the first name that comes to mind is LIC. But before buying a policy, it is important to do a comparison of LIC vs other Private insurers to ensure that you are getting the best value for your money.

A Brief History of the insurance sector in India

Insurance came to India in 1818 when the Oriental Life Insurance Company started operating in India although it served the interests of Britishers. The company started its operations in Calcutta.

After some years, the British Insurance companies started insuring Indians but charged more premiums as Indian lives were considered ‘sub-standard’ by these companies.

The first Indian Insurance company was the Bombay Mutual Life Assurance Society founded in 1870 which served Indians without charging extra premiums. Since then, many more insurance companies started operations.

LIC was created through the Life Insurance Act of 1956. In the same year, more than 200 insurance companies were nationalized(management and ownership were taken over by the Govt. of India).

For a more detailed history, check out this page on LIC website.

LIC vs Private Insurance companies

The government-owned insurance provider Life Insurance Corporation of India is the largest player in the sector with more than 66% market share. Private players such as Max Life, IDBI Federal. Tata AIA etc. are slowly increasing their market share.

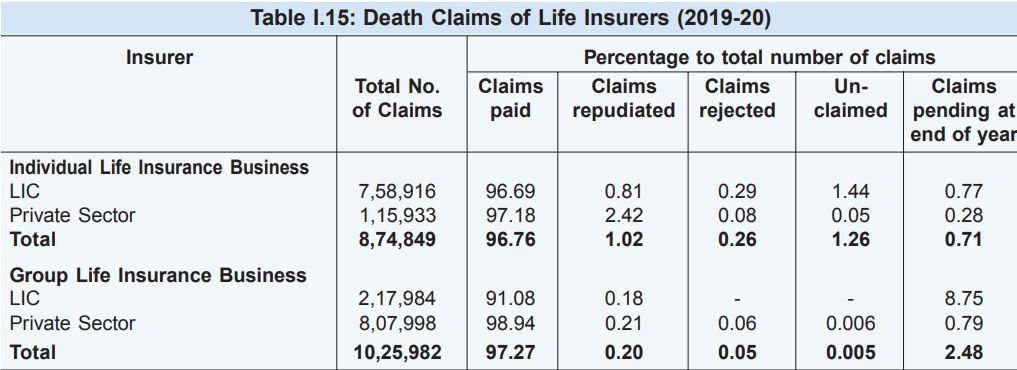

1. Claims Settlement Ratio – LIC vs Private Companies

The Claims Settlement Ratio of LIC for Individual Death claims was 96.69% (7,33,809 claims paid out of 7,58,916 claims registered). In the previous year i.e. 2018-19, it was 97.79%. Thus, the claims settlement ratio declined marginally by 0.81%.

The claims settlement ratio of Private Companies was slightly more than LIC at 97.18%. In the previous year, i.e. 96.64%.

2. Profit made by LIC vs Private Companies

LIC made a profit after tax of ₹2,717 crores in 2019-20. Private Insurers together made a profit after tax of ₹5,016 crores.

3. Dividend Paid in 2019-2020

LIC paid a dividend of ₹2,698 crores to its only shareholder that is the Government of India. Private Insurance companies paid a total dividend of ₹1215 crores.

4. Number of Offices

LIC has its offices in 669 districts of India out of a total of 735 districts. Private insurance companies have their presence in 592 districts across India. 39 districts of the North-Eastern states have no office of any Life insurance company.

Here are some other interesting facts that emerge from the IRDAI Annual report 2019-20.

- The Probability that you will die in a plane crash is 0.00024 and in the case of Indian Railways, the probability that you will die due to a train accident is 0.00032. Now you know why the Indian Railways offers us a cover of ₹10 lakhs for 50 paise only.

- As per the Amendments made to Insurance Act in 2015, it is illegal to sell directly or indirectly any insurance policy through a Multi-level Marketing scheme.

- Section 45 of the Insurance Act was amended for the benefit of the consumers of Life Insurance products and as per the latest provisions, after 3 years of issuance of the policy, no company can deny a claim on any grounds whatsoever. If the insurance company believes that it is being defrauded, it has to dispute this before the 3 year period.

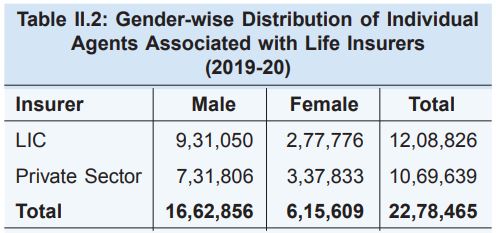

- There are over 22.78 lakh individual agents of Life insurance companies in India. Of these, 12.09 lakh agents (77% male and 23% female) are associated with LIC and 10.69 lakh(68% male and 32% female) with private insurance companies.

- Max Life Insurance settled the highest number of Individual death claims in 2019-2020 at 99.22% followed by HDFC at 99.07% and Tata AIA at 99.06%. The worst claims settlement ratio was reported by Edelweiss Tokio at 83.44% (272 claims paid out of a total of 326 claims made).

Some important data from the IRDAI Annual Report 2019-2020:

Conclusion

The IRDAI Annual report is a goldmine as it provides a very detailed overview of the insurance industry in India. It contains the data relating to various insurance companies and one can easily ascertain the health of a company by going through this report.

The information and data presented here has been sourced from the publically available Annual Report of the IRDAI for the year 2019-20.