Exchange-traded funds abbreviated as ETFs are not something new to the stock markets. Yet I have come across a large number of people who don’t know about them. There are a total of 122 ETFs listed on the National Stock Exchange in India. In this post, we will try to explain everything you need to know about ETFs in India and the list of ETFs in India.

The First Indian ETF

In India, the first ETF was launched by Nippon India Mutual Fund company, earlier known as Reliance Mutual Fund. The first ETF was a Nifty 50 ETF, called “NiftyBees” launched in December 2001. The ETF has given almost 16% return since inception and you can still purchase it. Now 20 years later, we have 122 ETFs are listed on the NSE.

1. What are Exchange-traded funds or ETFs?

From the name itself, you come to know that an ETF is some kind of ‘fund’ that is traded on the exchange. It is just like a mutual fund. The only difference is that you can buy or sell it on the stock exchange just like you buy and sell stocks. You will need a trading account for buying/selling an ETF and a Demat account where the ETFs will be stored.

An ETF is basically a collection of assets(stocks, bonds, or commodities such as Gold, Silver, etc).

ETFs are usually launched by Asset management companies that launch Mutual Funds. Examples of these companies are Motilal Oswal, ICICI Prudential, Nippon, Mirae Asset, etc.

An ETF is managed by a fund manager just like a mutual fund. An ETF has an expense ratio that denotes a fund management fee.

2. How many types of ETFs are available in India?

In India, ETFs are broadly classified into 4 categories, namely:

- Equity – these ETFs track equity indices such as Nifty 50, Sensex, Nifty IT, Nifty Midcap 150, etc.

- Debt – In the Debt category, ETFs track Bonds, etc,

- Precious metals – We have Gold ETFs and Silver ETFs tracking prices of the respective metals.

- International Equity Indices – You can invest in International stock indices such as Nasdaq 100, Hangseng, etc. through ETFs.

Later in this post, we will look at the list of all ETFs available in the above categories. You might get surprised by looking at the list of all ETFs available today.

Can you believe that it is now possible to invest in an index on the Hong Kong stock exchange through ETFs without needing to open an overseas account! Yes, markets are getting exciting for retail investors in India.

3. Listing of ETFs on the stock exchanges

The two most prominent stock exchanges in India are the National Stock exchange (NSE) and the Bombay Stock Exchange (BSE).

Almost all ETFs are listed by the Asset management companies list all their ETFs on both these exchanges.

You can very easily find them on your stock brokers app by searching their names. For example, try to type ‘NETFIT’ and you will find it there.

NETFIT is an ETF by Nippon AMC which tracks the Nifty IT Index. It does not matter much whether you buy them from NSE or BSE.

4. Can you list the differences between a mutual fund and an ETF?

Sure, let’s look at the similarities and the differences between a Mutual fund and an ETF in the table below:

| S No. | Exchange-Traded Fund (ETF) | Mutual Fund |

|---|---|---|

| 1. | Listed on stock exchanges such as NSE, and BSE. | Not Listed on stock exchanges |

| 2. | Lower expense ratios. | Higher expense ratio than ETFs |

| 3. | ETFs are managed by a fund manager | Also Managed by a fund manager |

| 4. | Can buy or sell anytime during trading hours on stock exchanges. | Cannot buy/sell on a stock exchange. |

| 5. | Demat account/Trading account is necessary to invest. | Demat/Trading accounts are not required. |

| 6. | No option to get a dividend payout. Only the Growth option is available. | You get the option to choose between Dividend payout (IDCW) or dividend reinvestment (Growth) |

| 7. | Intraday trading is possible. | Any sort of trading activity is not possible. |

| 8. | Sale Proceeds from holdings are received on a T+2 basis similar to any other stock. (here T is the day of sale) | When you sell your Mutual fund units, proceeds are sent to your bank on T+3 day. (here T is the day of sale) |

| 9. | No Minimum investment is defined. You can buy as low as 1 unit just like a stock. | Usually, a minimum investment is mandated by the fund houses such as Rs 500 or more. |

| 10. | SIP is not possible although some stockbrokers offer SIP through indirect means. | SIP option is available. |

5. What is “Expense Ratio” in Exchange-traded funds (ETFs)?

Exchange-traded funds, just like Mutual funds, are managed by a dedicated fund manager who is responsible for maintaining the fund and does the buying/selling of stocks for the fund. To pay for the salary of the fund manager and make some profit for the fund house, the fund levies a small charge called ‘Expense Ratio’.

Since most ETFs are passively managed, the expense ratio is usually extremely low and even lower than that of index funds. You can understand the difference through the following illustration in which we compare the expense ratios of an ETF with an index fund from the same company where both track the same underlying assets:

| Fund | Total Expense Ratio |

| Nippon India ETF Nifty BeES (ETF) | 0.05% |

| Nippon India Index Fund – Nifty Plan (Direct plan) (Index Fund) | 0.18% |

From the above table, we can see that the ETF is more than three times cheaper than a direct index fund which already is very cheap.

6. What are the benefits or advantages of investing through ETFs?

Exchange-traded funds come with numerous benefits such as:

- A very low minimum investment requirement of 1 unit.

- ETFs are passive funds and usually have lower risk than stocks.

- ETFs are an excellent choice for investing in broad market indices such as Nifty, Sensex, etc.

- They are very cheap because their expense ratios are usually very low (less than 0.5% mostly).

- ETFs can be purchased at real-time prices instead of closing day prices as in mutual funds.

- No need to contact a Mutual fund house or a broker. You can buy ETFs directly from your trading app.

7. What is ‘Tracking Error’ in the case of ETFs?

In any index fund or ETF, the returns generated do not exactly match the returns of the underlying asset. This difference is known as ‘Tracking Error’. The actual returns generated by the ETF could be less or more than the underlying asset being tracked. For tracking error to be zero, the asset allocation needs to exactly match the underlying portfolio at all times which is practically very hard to do.

What are the reasons for Tracking errors in ETFs?

Tracking errors may occur due to multiple reasons such as:

- The fund manager may not be able to allocate available money exactly in the same proportion as in the underlying portfolio due to corporate actions, expenses, and fees of the scheme, changes to the underlying index, regulatory restrictions, etc.

- Trading in some securities may be halted due to reasons such as activation of circuit breakers, making it impossible to invest at that time.

- Fund house may keep some cash aside for unexpected circumstances which may also lead to tracking errors.

8. How can I buy ETFs in India?

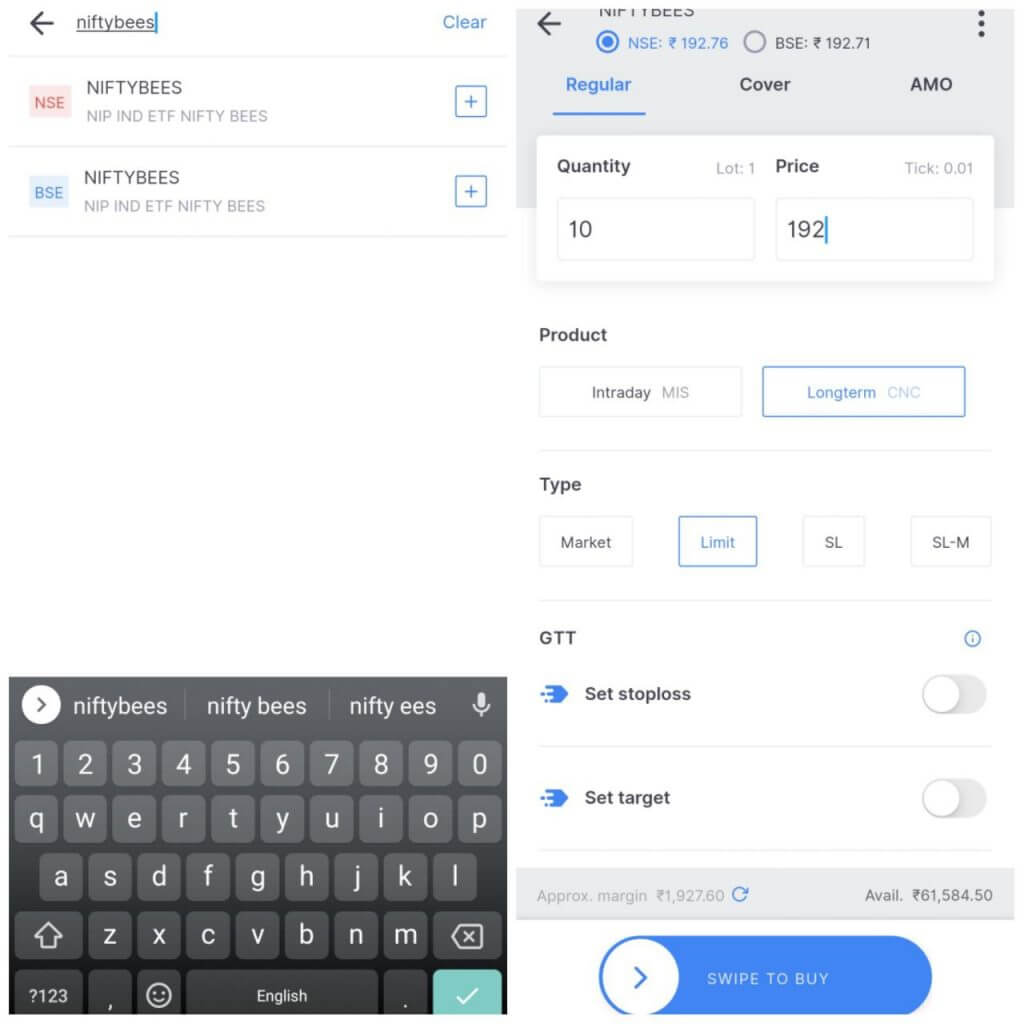

If you have been reading till here, you know that you need a trading and a Demat account to buy an ETF. The process is exactly similar to buying shares. Let me illustrate how to buy an ETF in Zerodha’s Kite mobile app.

9. How many ETFs are listed on NSE?

As of 11th April 2022, there are 122 ETFs listed on NSE. We have ETFs tracking Gold, Silver, Bonds, Equity broad market indices, Equity thematic indices, international equity indices, etc.

10. List of ETFs Listed in India

| S.No. | ETF Symbol | Name | Underlying Asset | Launch Date or Listing Date | Return since Launch (CAGR) | 1-Year (365 day) return % | 5-Year CAGR Return % | LTP (11-Apr-2022) | Total Expense Ratio % |

|---|---|---|---|---|---|---|---|---|---|

| 1 | ABSLBANETF | Aditya Birla Sun Life Banking ETF | Nifty Bank | 2019-10-30 00:00:00 | 10.97 | 16.04 | NA | 37.47 | 0.15 |

| 2 | ABSLNN50ET | Aditya Birla Sun Life Nifty Next 50 ETF | Nifty Next 50 | 2018-12-21 00:00:00 | 15.89 | 25.14 | NA | 44.8 | 0.05 |

| 3 | AXISBNKETF | Axis Banking ETF | Nifty Bank | 2020-11-09 00:00:00 | 24.96 | 16.04 | NA | 379.35 | 0.16 |

| 4 | AXISBPSETF | Axis AAA Bond Plus SDL ETF-2026 Maturity | Nifty AAA Bond Plus SDL Apr 2026 50:50 Index | 2021-05-18 00:00:00 | 3.56 | - | NA | 10.5 | 0.13 |

| 5 | AXISCETF | Axis Consumption ETF | NIFTY India Consumption Index | 2021-09-23 00:00:00 | -2.51 | - | NA | 71.49 | 0.33 |

| 6 | AXISGOLD | Axis Gold ETF | Gold | 2010-11-16 00:00:00 | 7.45 | 11.41 | 44.82 | 0.53 | |

| 7 | AXISHCETF | Axis Healthcare ETF | Nifty Healthcare Index | 2021-05-21 00:00:00 | -14 | - | NA | 84.16 | 0.22 |

| 8 | AXISNIFTY | Axis Nifty 50 ETF | Nifty 50 | 2017-07-07 00:00:00 | 14.67 | 20.31 | NA | 186.44 | 0.07 |

| 9 | AXISTECETF | Axis Technology ETF Regular Growth | NIFTY IT Index | 2021-03-31 00:00:00 | 35.63 | 29.23 | NA | 354.35 | 0.22 |

| 10 | BANKBEES | NIPPON INDIA ETF BANK BEES | Nifty Bank | 2004-05-27 00:00:00 | 17.34 | 18.08 | 11.45 | 379.9 | |

| 11 | BBETF0432 | Bharat Bond ETF - April 2032 | Nifty BHARAT Bond Index - April 2032 | 2021-12-17 00:00:00 | NA | 1009.99 | |||

| 12 | BSLGOLDETF | Aditya BSL Gold ETF | Gold | 2011-05-20 00:00:00 | 7.31 | 13.09 | 11.77 | 47.21 | 0.58 |

| 13 | BSLNIFTY | Aditya BSL Nifty 50 ETF | Nifty 50 | 2011-07-21 00:00:00 | 12.6 | 24.76 | 13.16 | 19.66 | 0.05 |

| 14 | BSLSENETFG | Aditya BSL Sensex 30 ETF | BSE SENSEX Index | 2016-07-18 00:00:00 | 13.37 | 19.87 | 13.51 | 56.33 | 0.08 |

| 15 | CPSEETF | CPSE ETF | Nifty CPSE TRI | 2014-03-28 00:00:00 | 8.09 | 4.26 | 36.35 | 0.01 | |

| 16 | DSPN50ETF | DSP Nifty 50 ETF | Nifty 50 Index | 2021-12-30 00:00:00 | 3.67 | - | NA | 178.8 | 0.07 |

| 17 | DSPNEWETF | DSP Nifty 50 Equal Weight ETF | NIFTY 50 Equal Weight Index | 2021-11-12 00:00:00 | -0.49 | - | NA | 200.55 | 0.3 |

| 18 | DSPQ50ETF | DSP Nifty Midcap 150 Quality 50 ETF | Nifty Midcap 150 Quality 50 Index | 2021-12-30 00:00:00 | -4.37 | - | NA | 173.79 | 0.3 |

| 19 | EBANK | Edelweiss Nifty Bank ETF | Nifty Bank | 2015-12-18 00:00:00 | 14 | 18.25 | 11.71 | 4000 | 0.12 |

| 20 | EBBETF0423 | Edelweiss Bharat Bond ETF-April 2023 ETF | Nifty BHARAT Bond | 2020-01-02 00:00:00 | 7.02 | 4.35 | NA | 1176 | 0.0005 |

| 21 | EBBETF0425 | Edelweiss Bharat Bond ETF-April 2025 ETF | Nifty BHARAT Bond | 2020-07-29 00:00:00 | 4.22 | 4.4 | NA | 1088.47 | 0.0005 |

| 22 | EBBETF0430 | Edelweiss Bharat Bond ETF-April 2030 ETF | Nifty BHARAT Bond | 2020-01-02 00:00:00 | 7.64 | 3.32 | NA | 1203 | 0.0005 |

| 23 | EBBETF0431 | Edelweiss Bharat Bond ETF-April 2031 ETF | Nifty BHARAT Bond | 2020-07-29 00:00:00 | 3.46 | 4.2 | NA | 1073.94 | 0.0005 |

| 24 | GOLDBEES | Nippon India Gold Bees ETF | Gold | 2007-03-19 00:00:00 | 11.09 | 14.58 | 11.36 | 44.93 | 0.79 |

| 25 | GOLDSHARE | UTI Gold ETF | Gold | 2007-04-17 00:00:00 | 8.84 | 44.7 | 1.06 | ||

| 26 | HBANKETF | HDFC Banking ETF | Nifty Bank | 2020-08-28 00:00:00 | 37.06 | 16.37 | NA | 376.63 | 0.16 |

| 27 | HDFCMFGETF | HDFC Gold ETF | Gold | 2010-08-19 00:00:00 | 8.64 | 15.56 | 11.58 | 46.2 | 0.6 |

| 28 | HDFCNIFETF | HDFC Nifty 50 ETF | Nifty 50 | 2015-12-16 00:00:00 | 15.25 | 21.78 | 15.07 | 189.81 | 0.05 |

| 29 | HDFCSENETF | HDFC Sensex 30 ETF | SENSEX | 2015-12-16 00:00:00 | 15.59 | 21.29 | 15.88 | 634.67 | 0.05 |

| 30 | HEALTHY | Aditya Birla Sun Life NIFTY Healthcare ETF | Nifty Healthcare TRI | 2021-10-28 00:00:00 | 0.14 | - | NA | 8.67 | 0.09 |

| 31 | HNGSNGBEES | Nippon India Hang Seng Bees ETF | Hang Seng Index | 2010-03-09 00:00:00 | 6.73 | -23.51 | 2.85 | 313.99 | 0.86 |

| 32 | IBMFNIFTY | Indiabulls Nifty 50 ETF | Nifty 50 | 2019-05-08 00:00:00 | 15.86 | 21.55 | NA | 180.15 | 0.12 |

| 33 | ICICI500 | ICICI Prudential BSE 500 ETF | S&P BSE 500 index | 2018-05-16 00:00:00 | 14.08 | 25.23 | NA | 25.49 | 0.29 |

| 34 | ICICIALPLV | ICICI Prudential Alpha Low Vol 30 ETF | Nifty Alpha Low-Volatility 30 Index | 2020-08-18 00:00:00 | 25.7 | 20.12 | NA | 174.95 | 0.41 |

| 35 | ICICIAUTO | ICICI Prudential Nifty Auto ETF | Nifty Auto Index | 2022-01-18 00:00:00 | -8.22 | - | NA | 109.5 | 0.2 |

| 36 | ICICIB22 | Bharat 22 ETF | S&P BSE BHARAT 22 index | 2017-11-28 00:00:00 | 7.39 | 44.18 | NA | 51.48 | 0.05 |

| 37 | ICICIBANKN | ICICI Prudential Nifty Bank ETF | Nifty Bank | 2019-07-15 00:00:00 | 7.29 | 18.1 | NA | 376.5 | 0.15 |

| 38 | ICICIBANKP | ICICI Prudential Nifty Private Bank ETF | Nifty Private Bank Index | 2019-08-14 00:00:00 | 7.3 | 11.49 | NA | 188.7 | 0.15 |

| 39 | ICICICONSU | ICICI Prudential Consumption ETF | Nifty India Consumption Index | 2021-11-02 00:00:00 | 0.31 | - | NA | 71.74 | 0.2 |

| 40 | ICICIFMCG | ICICI Prudential FMCG ETF | Nifty FMCG Index | 2021-08-10 00:00:00 | 5.11 | - | NA | 386.95 | 0.2 |

| 41 | ICICIGOLD | ICICI Prudential Gold ETF | Gold | 2010-09-02 00:00:00 | 8.18 | 12.06 | 11.22 | 46.1 | 0.5 |

| 42 | ICICILIQ | ICICI Prudential Liquid ETF | S&P BSE Liquid Rate Index | 2018-09-26 00:00:00 | 3.76 | 2.96 | NA | 999.99 | 0.25 |

| 43 | ICICILOVOL | ICICI Prudential Nifty 100 Low Vol 30 ETF | Nifty 100 Low Volatility 30 Index | 2017-07-10 00:00:00 | 13.99 | 16.61 | NA | 139.36 | 0.36 |

| 44 | ICICIM150 | ICICI Prudential Nifty Midcap 150 ETF | Nifty Midcap 150 | 2020-01-28 00:00:00 | 28.27 | 29.16 | NA | 118.52 | 0.15 |

| 45 | ICICIMCAP | ICICI Prudential Sensex Midcap Select ETF | S&P BSE Midcap Select Index | 2016-07-11 00:00:00 | 13.75 | 25.53 | 11.22 | 108.2 | 0.15 |

| 46 | ICICINF100 | ICICI Prudential Nifty 100 ETF | Nifty 100 | 2013-08-26 00:00:00 | 16.4 | 22.64 | 14.3 | 195.58 | 0.47 |

| 47 | ICICINIFTY | ICICI Prudential Nifty 50 ETF | Nifty 50 | 2013-03-26 00:00:00 | 14.5 | 21.44 | 15.06 | 190.51 | 0.05 |

| 48 | ICICINV20 | ICICI Prudential NV20 ETF | Nifty50 Value 20 | 2016-06-22 00:00:00 | 18.38 | 25.59 | 19.61 | 99.47 | 0.12 |

| 49 | ICICINXT50 | ICICI Prudential Nifty Next 50 ETF | Nifty Next 50 | 2018-08-30 00:00:00 | 10.93 | 26.55 | NA | 44.92 | 0.1 |

| 50 | ICICIPHARM | ICICI Prudential Healthcare ETF | Nifty Healthcare Index | 2021-05-25 00:00:00 | 3.53 | - | NA | 87.08 | 0.15 |

| 51 | ICICISENSX | ICICI Prudential Sensex 30 ETF | SENSEX | 2014-07-23 00:00:00 | 17.14 | 21.33 | 15.82 | 644.79 | 0.05 |

| 52 | ICICISILVE | ICICI Prudential Silver ETF | Domestic Price of Silver | 2022-01-31 00:00:00 | 9.99 | - | NA | 69.23 | 0.4 |

| 53 | ICICITECH | ICICI Prudential IT ETF | Nifty IT Index | 2020-08-20 00:00:00 | 48.39 | 34.79 | NA | 356.81 | 0.2 |

| 54 | IDBIGOLD | IDBI Gold ETF | Gold | 2011-11-17 00:00:00 | 5.03 | 15.3 | 11.81 | 4788 | 0.35 |

| 55 | IDFNIFTYET | IDFC Nifty 50 ETF | Nifty 50 | 2016-10-18 00:00:00 | 15.04 | 21.32 | 14.91 | 186.76 | 0.08 |

| 56 | INFRABEES | Nippon India Nifty Infra Bees ETF | Nifty Infra | 2010-10-05 00:00:00 | 3.06 | 26.84 | 10.75 | 541.25 | 1.08 |

| 57 | IVZINGOLD | Invesco India Gold ETF | Gold | 2010-03-22 00:00:00 | 9.05 | 15.75 | 11.61 | 4680 | 0.55 |

| 58 | IVZINNIFTY | Invesco India Nifty Exchange Traded Fund | Nifty 50 | 2011-06-17 00:00:00 | 12.46 | 21.74 | 15.03 | 1940.8 | 0.1 |

| 59 | JUNIORBEES | Nippon India Junior Bees ETF | Nifty Next 50 | 2003-02-21 00:00:00 | 20.13 | 28.59 | 11.74 | 461.13 | 0.17 |

| 60 | KOTAKALPHA | Kotak Nifty Alpha 50 ETF | NIFTY Alpha 50 Index | 2021-12-29 00:00:00 | 3.69 | - | NA | 36.59 | 0.4 |

| 61 | KOTAKBKETF | Kotak Nifty Bank ETF | Nifty Bank | 2014-12-12 00:00:00 | 9.94 | 18.04 | 11.42 | 381.52 | 0.18 |

| 62 | KOTAKGOLD | Kotak Gold ETF | Gold | 2007-08-08 00:00:00 | 11.91 | 14.81 | 11.56 | 45.14 | 0.55 |

| 63 | KOTAKIT | Kotak IT ETF | NIFTY IT Index | 2021-03-05 00:00:00 | 32.84 | 34.91 | NA | 35.45 | 0.22 |

| 64 | KOTAKNIFTY | Kotak Nifty 50 ETF | Nifty 50 | 2010-02-11 00:00:00 | 12.27 | 21.71 | 14.99 | 187.17 | 0.12 |

| 65 | KOTAKNV20 | Kotak NV20 ETF | Nifty50 Value 20 | 2015-12-09 00:00:00 | 18.11 | 25.56 | 19.77 | 100.8 | 0.14 |

| 66 | KOTAKPSUBK | Kotak Nifty PSU Bank ETF | Nifty PSU Bank | 2007-11-16 00:00:00 | 0.7 | 39.14 | -4.41 | 287.1 | 0.49 |

| 67 | LICNETFGSC | LIC MF G-SEC Long Term ETF | GSEC10 NSE Index | 2015-01-01 00:00:00 | 6.81 | -1.06 | 5.48 | 22.33 | 0.16 |

| 68 | LICNETFN50 | LIC MF Nifty 50 ETF | Nifty 50 | 2015-11-30 00:00:00 | 14.48 | 21.76 | 15.06 | 189.37 | 0.1 |

| 69 | LICNETFSEN | LIC MF Sensex 30 ETF | SENSEX | 2015-12-07 00:00:00 | 14.68 | 21.14 | 15.89 | 636.4 | 0.1 |

| 70 | LICNFNHGP | LIC MF Nifty 100 ETF | Nifty 100 | 2016-03-28 00:00:00 | 16.1 | 22.92 | 14.47 | 190.35 | 0.28 |

| 71 | LIQUIDBEES | Nippon India Liquid Bees ETF | Government Securities | 2003-07-16 00:00:00 | 5.61 | 2.51 | 3.72 | 1000 | 0.65 |

| 72 | LIQUIDETF | DSP BlackRock Liquid ETF | Nifty1D rate index | 2018-03-20 00:00:00 | 4.16 | 2.72 | NA | 1000 | 0.63 |

| 73 | MAESGETF | Mirae Asset ESG Sector Leaders ETF | NIFTY100 ESG SECTOR LEADERS | 2020-11-24 00:00:00 | 22.43 | 18.69 | NA | 30.02 | 0.64 |

| 74 | MAFANG | Mirae Asset NYSE FANG+ ETF | NYSE FANG+ Total Return Index | 2021-05-14 00:00:00 | -0.2 | - | NA | 47.95 | 0.53 |

| 75 | MAFSETF | Mirae Asset Nifty Financial Services ETF - RG | Nifty Financial Services Index | 2021-08-05 00:00:00 | 5.37 | - | NA | 17.65 | 0.13 |

| 76 | MAHKTECH | Mirae Asset Hang Seng TECH ETF | Hang Seng TECH Total Return Index | 2021-12-10 00:00:00 | -28.21 | - | NA | 13.75 | 0.43 |

| 77 | MAMFGETF | Mirae Asset Nifty India Manufacturing ETF | Nifty India Manufacturing Total Return Index | 2022-02-02 00:00:00 | 4.73 | - | NA | 83.15 | 0.4 |

| 78 | MAN50ETF | Mirae Asset Nifty 50 ETF | Nifty 50 | 2018-11-26 00:00:00 | 17.03 | 21.78 | NA | 183.2 | 0.08 |

| 79 | MANXT50 | Mirae Asset Nifty Next 50 ETF | Nifty Next 50 | 2020-01-31 00:00:00 | 20.47 | 28.87 | NA | 439.8 | 0.14 |

| 80 | MASPTOP50 | Mirae Asset S&P 500 Top 50 ETF | S&P 500 Top 50 Total Return Index | 2021-09-24 00:00:00 | 5.77 | - | NA | 29.28 | 0.59 |

| 81 | MOGSEC | Motilal Oswal 5 Year G-Sec ETF | Nifty 5 yr Benchmark G-Sec Index | 2020-12-16 00:00:00 | 1.87 | 2.51 | NA | 49.26 | 0.14 |

| 82 | MOM100 | Motilal Oswal Nifty Midcap 100 ETF | Nifty Midcap 100 | 2011-02-04 00:00:00 | 13.51 | 32.18 | 12.25 | 33.14 | 0.2 |

| 83 | MOM50 | Motilal Oswal Nifty 50 ETF | Nifty 50 | 2010-07-30 00:00:00 | 8.07 | - | 11.19 | 175.55 | 0.05 |

| 84 | MOMOMENTUM | Motilal Oswal Nifty 200 Momentum 30 ETF | Nifty 200 Momentum 30 Total Return Index | 2022-02-17 00:00:00 | 3.87 | - | NA | 209.65 | 0.33 |

| 85 | MON100 | Motilal Oswal NASDAQ 100 ETF | Nasdaq100 | 2011-03-31 00:00:00 | 24.07 | 0.0465 | 0.2512 | 112.76 | 0.58 |

| 86 | MONQ50 | Motilal Oswal Nasdaq Q 50 ETF | Nasdaq Q-50 Total Return Index | 2021-12-29 00:00:00 | -16.75 | - | NA | 55.75 | 0.42 |

| 87 | NCPSESDL24 | Nippon India ETF Nifty CPSE Bd Plus SDL-2024 Mat | Nifty CPSE Bond Plus SDL-24 | 2020-11-18 00:00:00 | 3.69 | 4.22 | NA | 108.03 | 0.15 |

| 88 | NETF | Tata Nifty 50 ETF | Nifty 50 | 2019-01-04 00:00:00 | 17.54 | 20.18 | NA | 184.5 | 0.08 |

| 89 | NETFAUTO | Nippon India Nifty Auto ETF | Nifty Auto Index | 2022-01-20 00:00:00 | -4.75 | - | NA | 109.4 | 0.22 |

| 90 | NETFCONSUM | Nippon India Nifty India Consumption ETF | Nifty Consumption | 2014-04-03 00:00:00 | 13.97 | 19.6 | 13.04 | 77.08 | 0.35 |

| 91 | NETFDIVOPP | Nippon India Nifty Dividend Opportunities ETF | Nifty Div Opps 50 | 2014-04-15 00:00:00 | 13.03 | 27.58 | 12.92 | 46.93 | 0.19 |

| 92 | NETFGILT5Y | Nippon India ETF 5 Year Gilt | Nifty 8-13 yr G-Sec Index | 2021-04-08 00:00:00 | 2.67 | 2.69 | NA | 49.68 | 0.09 |

| 93 | NETFIT | Nippon India ETF Nifty IT | Nifty IT | 2020-06-26 00:00:00 | 62.59 | 34.94 | NA | 35.78 | 0.22 |

| 94 | NETFLTGILT | Nippon India G-SEC Long Term ETF | Nifty GS 8 13Yr | 2016-07-05 00:00:00 | 6.35 | -1.44 | 5.64 | 22.19 | 0.1 |

| 95 | NETFMID150 | Nippon India Nifty Midcap 150 ETF | Nifty Midcap 150 | 2019-01-31 00:00:00 | 22.77 | 29.21 | NA | 118.75 | 0.23 |

| 96 | NETFNIF100 | Nippon India Nifty 100 ETF | Nifty 100 | 2013-03-22 00:00:00 | 14.22 | 22.55 | 13.72 | 186.89 | 0.53 |

| 97 | NETFNV20 | Nippon India NV20 ETF | Nifty50 Value 20 TRI | 2015-06-18 00:00:00 | 15.63 | 24.17 | 19.93 | 102.25 | 0.36 |

| 98 | NETFPHARMA | Nippon India NIFTY Pharma ETF Growth Plan | NIFTY Pharma TRI Index | 2021-07-02 00:00:00 | 38.42 | - | NA | 13.86 | 0.21 |

| 99 | NETFSDL26 | Nippon India ETF Nifty SDL-2026 Maturity | Nifty SDL Apr 2026 Top 20 Equal Weight Index | 2021-03-25 00:00:00 | 5.17 | 4.48 | NA | 107.55 | 0.15 |

| 100 | NETFSILVER | Nippon India Silver ETF | Domestic Price of Silver | 2022-02-02 00:00:00 | 13.61 | - | NA | 66.72 | 0.54 |

| 101 | NIFTYBEES | Nippon India Nifty 50 Bees ETF | Nifty 50 | 2001-12-28 00:00:00 | 15.82 | 21.8 | 15.11 | 191.96 | 0.05 |

| 102 | NPBET | Tata Nifty Private Bank ETF | Nifty Private Bank Index | 2019-09-09 00:00:00 | 9.26 | 9.92 | NA | 192.12 | 0.14 |

| 103 | PSUBNKBEES | Nippon India Nifty PSU Bank Bees ETF | Nifty PSU Bank TRI | 2007-10-25 00:00:00 | 0.98 | 41.77 | -4.3 | 32.06 | 0.49 |

| 104 | QGOLDHALF | Quantum Gold ETF | Gold | 2008-02-28 00:00:00 | 10.04 | 12.1 | 11.36 | 44.78 | 0.78 |

| 105 | QNIFTY | Quantum Nifty 50 ETF | Nifty 50 | 2008-07-18 00:00:00 | 12.26 | 20.76 | 14.97 | 1854 | 0.09 |

| 106 | SBIETFCON | SBI ETF Consumption | Nifty India Consumption Index | 2021-06-30 00:00:00 | 6.68 | - | NA | 71.34 | 0.3 |

| 107 | SBIETFIT | SBI ETF IT | Nifty IT Index | 2020-10-06 00:00:00 | 46.29 | 33.73 | NA | 357.55 | 0.22 |

| 108 | SBIETFPB | SBI ETF Private Bank | Nifty Private Bank Index | 2020-10-06 00:00:00 | 15.84 | 12.9 | NA | 191.84 | 0.15 |

| 109 | SBIETFQLTY | SBI - ETF Quality | Nifty 200 Quality 30 Index | 2018-12-17 00:00:00 | 24.37 | 18.77 | NA | 152.95 | 0.5 |

| 110 | SETF10GILT | SBI - ETF 10 Year Gilt | Nifty 10 yr Benchmark G-Sec Index | 2016-06-02 00:00:00 | 5.9 | -2 | 4.77 | 199 | 0.14 |

| 111 | SETFGOLD | SBI - ETF GOLD | Gold | 2010-09-17 00:00:00 | 9.34 | 11.95 | 11.44 | 46 | 0.52 |

| 112 | SETFNIF50 | SBI - ETF Nifty 50 | Nifty 50 | 2015-07-17 00:00:00 | 12.34 | 21.04 | 0.1501 | 181.43 | 0.07 |

| 113 | SETFNIFBK | SBI - ETF Nifty Bank | Nifty Bank | 2015-03-02 00:00:00 | 10.17 | 16.97 | 0.1106 | 376.38 | 0.2 |

| 114 | SETFNN50 | SBI - ETF Nifty Next 50 | Nifty Next 50 | 2015-03-02 00:00:00 | 12.12 | 26.19 | 0.1122 | 455 | 0.15 |

| 115 | SHARIABEES | Nippon India Nifty Shariah Bees ETF | ShariahNifty 50 Shariah TRI | 2009-03-18 00:00:00 | 15.04 | 16.44 | 15.18 | 441.82 | 1.03 |

| 116 | SILVER | Aditya Birla Sun Life Silver ETF | Physical price of Silver | 2022-02-03 00:00:00 | 12.61 | - | NA | 69.01 | 0.36 |

| 117 | TECH | Aditya Birla Sun Life Nifty IT ETF | Nifty IT TRI Index | 2021-11-03 00:00:00 | -0.59 | - | NA | 34.99 | 0.22 |

| 118 | UTIBANKETF | UTI Bank ETF | Nifty Bank | 2020-09-04 00:00:00 | 35.58 | 17.24 | NA | 37.65 | 0.16 |

| 119 | UTINEXT50 | UTI Nifty Next 50 ETF | Nifty Next 50 | 2017-08-04 00:00:00 | 9.05 | 29.23 | NA | 45.82 | 0.15 |

| 120 | UTINIFTETF | UTI Nifty 50 ETF | Nifty 50 | 2015-09-01 00:00:00 | 13.88 | 20.8 | 14.89 | 1869.4 | |

| 121 | UTISENSETF | UTI Sensex 30 ETF | SENSEX | 2015-09-01 00:00:00 | 14.07 | 20.84 | 15.66 | 622.5 | 0.06 |

| 122 | UTISXN50 | UTI S&P BSE Sensex Next 50 ETF | BSE Sensex Next 50 | 2019-03-13 00:00:00 | 13.2 | 29.8 | NA | 52.84 | 0.22 |

In the above table, you will find the list of all the 122 ETFs listed on NSE.

The 1-year and 5-year annualized returns have been calculated from inception till the third week of April 2022 and may not be perfectly accurate. Please re-verify the Returns data before making any decision.

Further, the expense ratios are liable to be changed by the fund house in the future although this is rare.

11. Some observations from the list of ETFs

Some interesting facts emerge from studying the above table containing the list of ETFs listed above. Let us have a look:-

- 17 ETFs are tracking the Nifty 50 index. The expense ratio ranges from 0.05 to 0.12

- 5 ETFs track Sensex. Here the cheapest ETF’s expense ratio is 0.05 and the most expensive one’s expense ratio is 0.1

- Five ETFs are available for investing in the following international equity Indices:-

- Hang Seng Index

- Hang Seng TECH Total Return Index

- S&P 500 Top 50 Total Return Index

- Nasdaq100

- Nasdaq Q-50 Total Return Index

- Read this article to know more about investing in international equities: The easiest way to invest in the US stock markets from India

- Many ETFs are available that track thematic equity indices such as FMCG, IT, Healthcare, Manufacturing, Infra, Bank, Automobile.

Gold and Silver ETFs in India

- Eleven Gold ETFs are available in India. Check the above table for the complete list.

- IDBI Gold ETF (IDBIGOLD) has the lowest expense ratio of 0.35. UTI Gold ETF (GOLDSHARE) is the most expensive with an expense ratio of 1.06

- There are three ETFs tracking the domestic price of Silver in India.

- ICICI Prudential Silver ETF with the ticker “ICICISILVE” was listed on NSE on 31 January 2022 and has an expense ratio of 0.4

- Nippon India Silver ETF with the ticker “NETFSILVER” was listed on NSE on 02 February 2022 and has an expense ratio of 0.54

- Aditya Birla Sun Life Silver ETF with the ticker “SILVER” was listed on NSE on 03 February 2022 and has an expense ratio of 0.36. The expense ratio of Aditya Birla Sun Life Silver ETF is the lowest among its peers.

12. Are ETFs recommended for beginners?

Most equity ETFs track stock indices containing multiple stocks. Consequently, the risk is reduced due to diversification. However, the downside is that the returns also become limited. But overall, ETFs are a wonderful instrument for investing in the stock markets for beginners and experienced alike. If you want to invest in passive funds, ETFs are the way to go apart from index funds.

13. Why are ETFs not popular or Why nobody talks about ETFs?

ETFs are passive funds with very low expense ratios and are tradeable on the stock exchanges, unlike mutual funds. Nobody has the incentive of selling these funds. Therefore, no salesperson or broker talks about ETFs. Remember, commission-free products are very less popular but this does not mean that they are bad.

14. What is the Bharat Bond ETF?

Bharat Bond is a passive debt fund issued by Indian PSU companies. It is a very low risk and offers a better yield than Bank FDs. Bharat Bond ETFs are available and can be bought by the interested people.

Famous Options trader PR Sundar recommends buying the Bharat Bond ETF and pledging it to conduct trades. However, this may not be suitable for all. You can watch his video here – My BIGGEST Trading Secret – Earn EXTRA 7% Guaranteed!

Conclusion

The motivation for this article was my frustration of not being able to find the list of ETFs available in India. I observed that recently ETFs have been gaining momentum among retail investors. Be it investing in Gold or indices such as Nifty or Sensex, ETFs is becoming the investor’s favorite. In the last year, we saw various new ETFs being launched. I could not find out the ETF ticker, expense ratio, etc in one place and so I decided to compile this list. I hope my effort will be of some value to my precious readers. Please let me know in the comments if this helped you. Thanks for reading.