If you ever wondered how to invest in companies from the United States, you are not alone. Newbies usually ask how can someone from India buy shares of companies such as Apple, Dell, Google, etc. You may want to buy them for diversifying your portfolio or just because you want to invest in popular brands such as Google or Apple. There are some ways to buy US stocks in India and if you already have an account with any Indian Broker, you can invest in the US stock markets very easily.

Three ways to invest in US stocks from India

There is more than one way to buy US stocks directly from India. If you want to invest in individual stocks, you can:

1. Buy US Stocks through Indian Brokerages

Many Indian brokerages such as HDFC Securities, Kotak Securities, etc. allow you to open an overseas trading account through their partnerships with foreign brokers.

2. Invest through International brokers

Open a trading account with an international brokerage such as Interactive Brokers, Stockal, Tradestation, Charles Schwab brokerage, etc. Note that some of these brokers may charge a high fee compared to Indian counterparts. You can compare different international stockbrokers here.

3. The easiest way – Invest in the US stock market via ETFs and Index funds –

What are Index funds and ETFs?

| Index Funds | ETFs |

|---|---|

| Index funds are essentially passive mutual funds copying the stock portfolio of a stock index. Some popular indexes in India are Nifty having top 50 shares and Sensex with the top 30 shares according to market capitalization. We, therefore, have Nifty Index funds and Sensex Index funds among various other index funds. They are passively managed, unlike mutual funds due to which their expense-ratio is lower than mutual funds. |

Exchange-traded funds (ETFs) are essentially index funds that are traded on the stock exchanges like any other stock. However, ETFs tracking assets such as gold are also available. Their expense ratio(fund-management fee) is extremely low compared to mutual funds. Some common ETFs are ICICINIFTY, GoldBees, Juniorbees N100, M100, etc |

Some Prominent US Stock Indexes

There are around 5000 indexes in the US! But only a top few are well known and tracked broadly by investors over the world to gauge the market sentiment. Some widely used US indexes are:

- S&P 500 – Consists of the top 500 listed companies based on factors such as market capitalization, liquidity, financial strength etc. The S&P 500 represents roughly around 80% of the value of all the market and hence is a good indicator of the overall market.

- DJIA – The Dow Jones Industrial Average Index is a very old index of 30 blue-chip companies and represents around 25% of the market value of all US stocks.

- Nasdaq Composite Index – Nasdaq is a stock exchange on which mostly tech companies are traded although few companies from other sectors are also listed on it. The Nasdaq Composite Index consists of all the companies listed on the Nasdaq. Nasdaq Composite is based on the market-cap-weighted average technique.

- Nasdaq 100 – The Nasdaq 100 index is made up of 100 largest and most traded companies listed on the Nasdaq exchange from the tech, retail, biotechnology, industrial, health care, and other sectors excluding any companies from the financial sector. It contains companies such as Apple, Google, AMD, NVIDIA, Alphabet, Amazon, Microsoft, and many other giants.

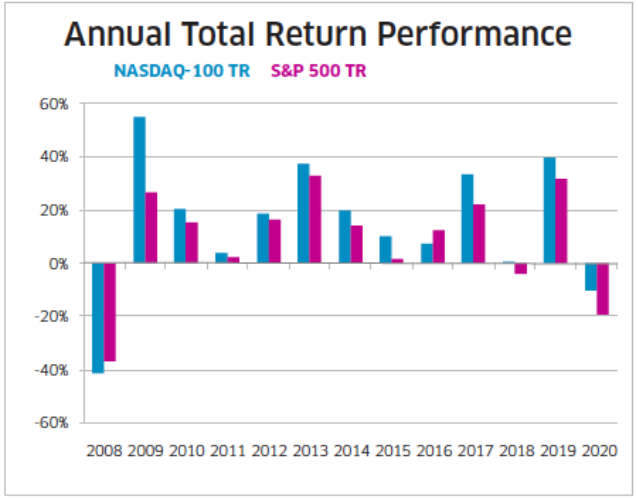

Caution: Do not make investment decisions solely on the basis of past performance.

How to Invest in US indexes from India

Buying Index funds, Mutual funds, or ETFs are the easiest ways of investing in the US stock markets. At present, we can invest in two US stock indexes – the S&P 500 and Nasdaq 100. All you need is an account with an Indian broker such as Zerodha, ShareKhan, HDFC Securities, etc. If you already have that, congrats! The following options are available for Indian investors right now:

1. Nasaq 100 ETF- N100 by Motilal Oswal

The Nasdaq 100 is a US Stock index made up of 100 largest non-financial companies based on market capitalization.

The performance of the N100 ETF has been outstanding since its inception in 2011. More than 22% compounded return since launch is nothing short of spectacular. But we are not analyzing the fundamentals of ETF in this blog so let’s move on to the next option.

2. Motilal Oswal S&P 500 Index fund

The Motilal Oswal’s new Index fund mimics the largest stock Index of the United States i.e. the Standard & Poor’s 500 (S&P500) index. The S&P500 consists of the top 500 companies in the USA. This is a brand new fund from Motilal Oswal and comes with an expense ratio of 0.5% for the direct plan and 1% for the regular plan. The exit load is 1% if you exit before 3 months.

3. Other Indian Mutual funds investing in US companies

Other than the two low-cost options listed above, there are some Indian mutual funds investing in US securities. Some options are:

- ICICI Pru US Bluechip Equity – D (G)

- Reliance US Equity Opp. Fund DP (G)

- Franklin India Feeder – US Opportunities

- DSP Flexible US Equity

You may also like to read:

- 10 smart hacks to get the most out of your credit card

- 5 cool things to do before turning 30

- 5 facts you don’t know about the 92-year-old Warren Buffett

Direct and Regular Mutual funds: Which one should I buy?

There are two variants of mutual funds: Regular and Direct. The expense ratio, which is the fund management fees, is always higher in the Regular scheme than the direct variant because it includes the commission of the broker/agent who sells it to you. Regular plans can be costlier by up to 1%, which although does not seem to be too much in the near term but actually erodes your gains over the years.

To understand the difference between the two, let us say there is a Mutual fund called ABC and the expense ratios of the direct plan and the Regular plan are 1% and 2% respectively.

Suppose you invested Rs. 10 lakh in both of them and the fund returns a 13% CAGR over 20 years. Obviously your money in the direct plan would have grown more than in the regular variant but can you guess the difference 1 extra % would make in 20 years?

You would be shocked to know that our final amount in the Regular scheme after 20 years is Rs. 80.62 lakhs and in the Direct scheme would be Rs. 96.46 lakhs.

A 1% difference is equal to Rs. 16 lakh over 20 years. This is why we always suggest you go for the direct plan. If however, you need assistance in your investing, you can consider taking the help of an advisor.

Where can I buy Direct Mutual Funds in India?

You can buy the direct plan of the mutual funds directly through the Mutual fund company’s website or from some external players such as MyCams, Groww, or Zerodha’s Coin platform. You can compare different schemes from various companies on these platforms. I have been using Zerodha as my broker for the last 2 years, and I can safely recommend it to you. It is a discount broker, and the fees are low. The Coin platform for investing in commission-free Direct plans of mutual funds is also free of charge.

How much money can an Individual Indian invest in the overseas markets?

In any financial year, you can invest up to a maximum of $2,50,000 outside India. There is a limit set by the RBI called the Liberalized Remittance Scheme (LRS) which allows resident Individuals to transfer or carry a total maximum of $250000(~Rs. 1.9 crores) outside India in a financial year. To learn more about the LRS, you can watch this informative lecture video below or see the RBI’s website.

Takeaway

There are multiple ways of investing in US stock markets from India. Sophisticated investors with large capital might want to open overseas trading accounts with Indian or International brokerage houses. But investors who do not have the expertise of selecting individual stocks must not venture out just because of the glamour of the United States. Not all companies in the US are good for an investor. Numerous factors determine the quality of a business. If you are relatively new to the markets, index funds and ETFs are your best bets.

Nice