Nifty Next 50 index funds and in general all Index funds are gaining momentum among Indian investors. From a Rs 9,000 crore market in 2008, passive funds now hold more than Rs 1 lakh crore of investor’s money. Due to their low cost and high returns, they are said to be the best choice for investors who do not know much about the stock markets. A common argument against Index funds is that they are suitable for mature stock markets such as that of the USA. However, as per the facts and figures, this statement does not hold good.

On digging deeper and studying the performance of broad market indices such as the Sensex, Nifty 50, and Nifty Next 50, we found that the returns generated by them are quite impressive. In this article, we will look at the Nifty next 50

The Nifty Next 50 is a collection of the next 50 most valued companies listed on the National Stock Exchange after the Nifty 50. Nifty Junior includes both large-cap and mid-cap companies. It was launched in December 1996 and is maintained by the NSE. The base value of Nifty Junior is 1000. The method of calculation of this index is free-float market capitalization.

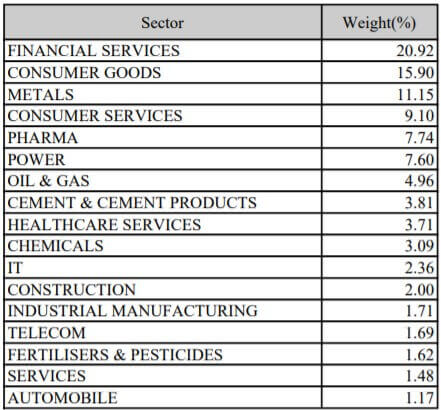

Nifty Next 50 Composition

Nifty Next 50 contains stocks from the large-cap as well as mid-cap. The beauty of the portfolio is that it is well diversified. In the last 18 years(till 2019), as many as 41 stocks have been upgraded from the Nifty Junior to Nifty 50. 27 of them are still part of it. This essentially means that Nifty Next 50 stocks have

- CONSUMER GOODS

- FINANCIAL SERVICES

- PHARMA

- AUTOMOBILE

- CEMENT & CEMENT PRODUCTS

- INDUSTRIAL MANUFACTURING

- ENERGY

- SERVICES

- METALS

- IT

- TELECOM

- CHEMICALS

- POWER

- CONSTRUCTION

- OIL AND GAS

- HEALTHCARE SERVICES

- FERTILIZERS & PESTICIDES

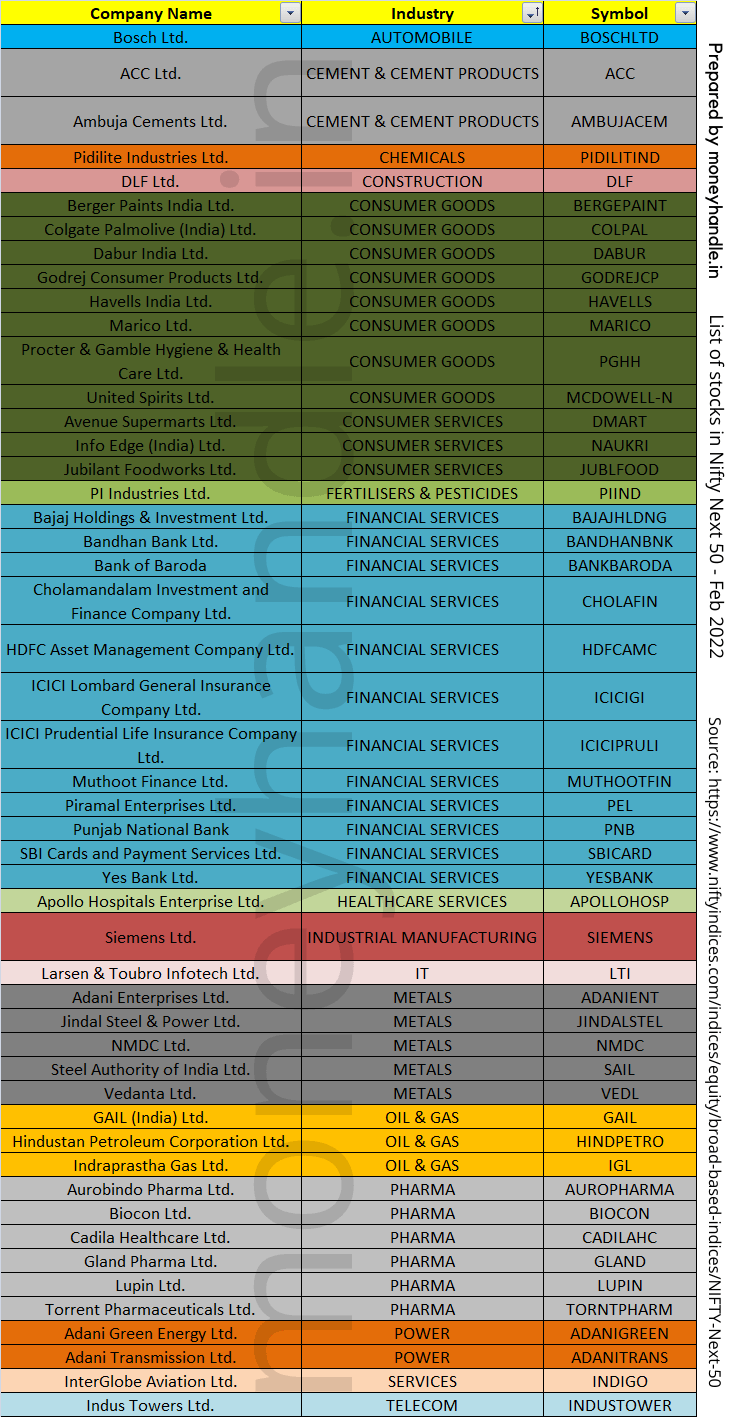

The 50 stocks present in the portfolio are:

Performance of the Nifty Next 50

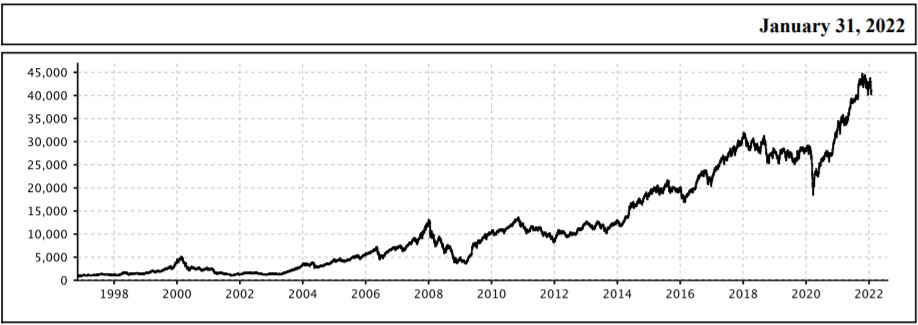

On 1 January 1997, Nifty next 50 had a value of 1077.83. On 31st December 2021, it closed at 42217.00. Crazy! 39 times in 25 years, which means that your money doubled every 4.7 years. If you had invested Rs 1 lakh in the index, it would have become almost 39 lakhs without doing anything. That’s over 15.8% of Compounded annual growth rate(CAGR) over 25 years. No bank FD can dare to offer such a rate.

This is a great return if you are a reasonable investor and you know that the stock market is a long-term investment vehicle and not some get-rich-quick scheme. I’m not saying that you cannot get greater returns from the stock market, but it is no easy task and requires a lot of skill, passion, and hard work for finding good companies.

Beating the market is possible but only a few are able to do so. Warren Buffet is regarded as the world’s most successful investor. Even his portfolio grew at approx 19% CAGR over the years.

Nifty Junior vs Nifty 50

Let us compare the returns of Nifty Next 50 with its big brother, the Nifty 50.

From the above table, you can easily observe that Nifty Next 50 has outperformed the Nifty 50. Since 1997, it has given an annualized return of 15.99%, as compared to 12% of the Nifty 50, a substantial excess return of 3.99%. The 10, 7, and 5-year returns have also outperformed the Nifty 50 by 5.79%, 6.05%, and 5.26% respectively. These numbers are not insignificant and cannot be ignored.

New to the stock markets? You may find these posts helpful:

The stock market vocabulary: 20 common terms for beginners

Is SIP better than lumpsum investments in Mutual Funds?

Capital gains tax (India) simplified – Read this if you invest in stocks

What are Shares?

The fact that Nifty Next 50 is a diversified index and includes relatively smaller and

The index has given a positive return in 19 out of 24 years. However, there exists volatility and fluctuations. The year 2000, 2001 were the dot com bubble burst years which eroded the gains. Then we had the 2008 crisis pulling down the index by 64%. No one can predict next year. Due to this volatility, investors are always advised to take a long-term approach to minimize risk. From Table 1 it is evident that in long term, the rewards are amazing. All that is required is patience.

How to invest in Nifty Next 50?

The most important question indeed! Well, there are two ways to invest in the index:

- Index Funds

- Exchange Traded Funds (ETF)

Index funds options available are:

IDBI Nifty Junior Index Fund

ICICI Prudential Nifty Next 50 Index Fund

UTI Nifty Next 50 Index Fund

Apart from the above 3 funds, a new index fund from DSP is going to be launched. However, it is wise not to buy a

You can buy index funds from a distributor or you can buy them directly online. Distributors will sell you the Regular plan whose expense ratio is a little higher than the Direct option. You can buy the Direct plan online directly from the fund house or from other platforms such as MyCams or Zerodha’s Coin.

You also have the option to buy ETFs. Unlike Index funds, ETFs lie in your Demat account and can be sold anytime when the market is open. The expense ratios of ETFs are lower than index funds. The following options are available.

Reliance ETF Junior BeES

ICICI Prudential Nifty Next 50 ETF

UTI Nifty Next 50 Exchange Traded Fund

SBI ETF Nifty Next 50 Fund

Here’s a nice article to help you decide which fund to buy?

Verdict

Nifty Next 50 is a great option for people looking to invest money in a multi-cap fund. In the medium to long term, the returns in the past have been impressive. There can be jerks in your journey but patience ultimately pays off. Investing in a disciplined way through SIPs is the smartest way to go. I prefer Index funds over ETFs because you do not have the SIP option in ETFs. Your doubts and suggestions are welcome.

Note: The article was last updated on 26-Feb-2022. Please note that Table 1: Nifty Next 50 vs Nifty CAGR Returns is based on data till 2018. It will be updated soon.

Fabulous analysis dude

very clearly explained and transparent analysis & suggestions, Thanks

Dear Dr Rajiv, I am happy to read your comment. Thanks for visiting moneyhandle and all the best with with your investment journey.