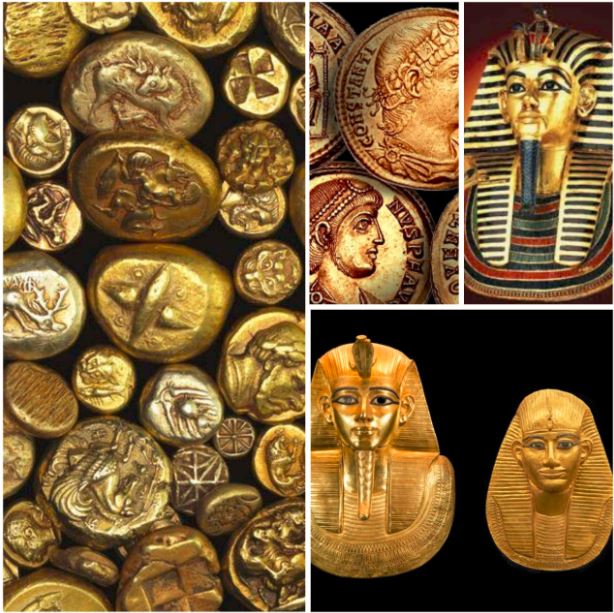

For thousands of years, the beauty and rarity of gold have made it a popular option for investors. Indeed, gold coins were one of the original types of currency, used in China and the Near East from the Iron Age on. Persian kings and Greek and Roman emperors coined gold currency emblazoned with their images.

Gold has long been envied for its portability: Ten grams of gold is currently worth over $630 or ₹48,000. During wars, gold has provided some security to those fleeing battle zones. For example, middle class and rich persons who had to flee their homes often carried gold items with them, such as cigarette lighters and jewelry, to be used for barter or bribery.

Those who did not have to flee, benefitted from owning gold, which preserved their purchasing power during the social upheaval. Indeed, currency expert James G. Rickards, cites three “secrets” of the wealthy who survive economic crises: they own gold, real estate, and fine art.

Modern democracies used to peg their currencies to gold, but all have abandoned this practice, including Switzerland, which abandoned the gold standard in 1999.

Still, central banks invest in and store gold as insurance against economic crises. In this scenario, it’s expected that gold will hold its value, even as a national currency is devalued.

The Reserve Bank of India (RBI) purchased more than 40 tons of gold in the FY 2019-2020. The total gold RBI holds is more than 600 tons.

The good news is you can act as your own central bank and invest in gold too in order to preserve your purchasing power.

Three Things to Know Before You Invest in Gold

Before investing in any type of commodity, mutual fund, or stock, it is important to get an understanding of the market, including the pros and cons of investing. Before you begin investing in gold, here are a few key things you need to know.

Gold Is Traditionally Seen as a Hedge Against Inflation

For centuries gold has been considered a safe haven asset that can preserve one’s purchasing power in the event of economic collapse or hyperinflation.

Gold has been making headlines for these reasons since the spread of the coronavirus pandemic.

- Some influential hedge fund founders like Paul Singer are bullish on gold as they expect significant currency devaluation to follow the US government’s spending of trillions of dollars in stimulus.

- Gold just broke above the $1,800 resistance mark in a move seen as a key milestone.

- Gold futures are up 18% year-to-date (YTD) beating all other major commodities, which are negative YTD.

- Initial concerns about gold’s price potentially being held back by decreased demand for jewelry in China and India have been eclipsed by the rally in gold.

- Negative real rates are also driving interest in gold, including in India.

Inflation is the increase in the general price of goods and services in a particular currency. For example, think of how much $10 would buy at the grocery store in 1970 versus what you can purchase for the same $10 today. That difference is inflation.

For the last two decades, gold has increased in value faster than inflation. And despite many ups and downs, gold has greatly out-performed inflation since 1970 — having increased in value 7-fold in real dollars.

There have been numerous analysts who previously warned that conditions were favorable for a market crash and that gold could perform the function of “insurance” against such a crisis. For example:

- Mining financier and entrepreneur Frank Giustra has been warning for some time of the dangers of the “global debt bubble” and US Federal Reserve bank policies. He believes we’re approaching the end of US dollar dominance and that gold is the “unfortunate final refuge.”

- For years James G. Rickards, a former CIA and Pentagon advisor, has been recommending that individuals invest 10% of their portfolio in gold as protection against the decline of the US dollar. Now, according to Reuters, private banks are recommending the same to their wealthy clients.

But it’s also important to understand that not everyone has this view of gold. For example, Warren Buffet has famously said that gold is a “huge favorite of investors who fear almost all other assets, especially paper money.”

And some hedge funds that sought refuge in gold during the 2008 recession did not see inflation play out the way they expected.

The Price of Gold Can Be Volatile

As we’ve mentioned, the price of gold has risen considerably over the last five decades. But it is volatile.

For this reason, it’s more suited for long-term investing, as short-term day trading requires significant knowledge and experience.

It’s also worth noting that “extreme behavior” has been observed in the world’s stock markets and more unpleasant surprises (like the crude oil crash of April 2020) may be in store. There are, of course, no guarantees of profit for any investment.

There Are Multiple Ways to Invest in Gold

When it comes to investing in gold, there are multiple ways to invest in it. In the next section we’ll take a look at these.

How to Invest in Gold?

There are a surprising number of options for investors who want to buy gold.

Physical Gold For Delivery or Storage

One way that physical gold (also called gold bullion) can be purchased is in the form of coins or bars. You can purchase these from reputable online dealers/jewelers who will ship the gold to your home.

You can also just walk into a jewelry shop and buy pure gold coins and bars. Just make sure to verify the BIS Hallmark sign of purity.

Coins and Bars For Delivery (For consumers in the USA)

The most common form that comes to mind are the large gold bars featured in heist movies like The Italian Job. Gold bars traded by institutions on commodities exchanges are a standard 100 ounce size, so one bar would be worth over $180,000 or ₹13,483,107.

But online dealers offer many sizes of gold bars, to suit any budget. For example, you can buy tiny 1 gram bars. (If you are buying a small amount of gold you might also consider purchasing it in jewelry form.)

The most popular coins are those minted by governments. The most common weight is 1 troy ounce. These are often referred to by colloquial terms that refer to their designs. For example, there are:

- American Gold Eagles

- Canadian Gold Maple Leafs

- Austrian Gold Philharmonics

American Gold Eagles also come in smaller weights: one-half of an ounce, one-fourth of an ounce, and one-tenth of an ounce.

Physical Gold Stored in a Vault

Physical gold can also be purchased via an online service that will provide storage services.

Two well-known services are BullionVault.com and GoldMoney.com. The latter charges a minimum $10/month fee which makes it ideal for larger investors, whereas BullionVault.com charges no minimum storage fee.

Once you buy the bullion online you may choose from different cities to store it in, such as Zurich, Toronto, or Singapore. Respected third-party services, such as Brinks and Via Mat, handle the logistics and storage.

For investing in gold and silver digitally, Indian consumers can try Bullionindia.in. Your gold is stored in a secure and insured vault and you will have the option of getting your gold delivered to you in the form of coins whenever you want.

Investing in Gold Via the Stock Market

Buying shares in a gold stock or ETF is a convenient method to invest, but it’s important to understand what you’re buying.

Gold CEFs (For consumers in the USA)

The largest gold CEF (closed-end fund) is Canada’s Sprott Physical Gold Trust which trades under the ticker symbol PHYS. Shares are currently at over $14 or ₹1,048.

When you buy shares in PHYS you own the underlying gold. Shares are 100% allocated to physical gold and Sprott provides means by investors may obtain delivery of their gold. (This requires meeting certain criteria.)

Indeed, PHYS is one of the most cost-efficient means of investing in gold.

ETFs Backed by Physical Gold

There are also gold ETFs that are backed by physical bullion. Bullion-backed ETFs mirror gold’s price movements.

These ETFs are structured as “grantor trusts” and they retain ownership of the gold in most cases. There are exceptions, as with the Perth Mint Physical Gold ETF (AAAU), which allows investors to take physical delivery of the gold they own. When you sell your shares of gold-backed ETFs you will be taxed as though you are the owner of the physical gold.

Popular gold-backed ETFs listed on US Exchanges:

- GraniteShares Gold Trust (BAR)

- SPDR Gold MiniShares Trust (GLDM)

- iShares Gold Trust (IAU)

Gold ETFs listed on Indian Exchanges:

- Axis Gold ETF (AXISGOLD)

- Birla Sun Life Gold ETF (BSLGOLDETF)

- HDFC Gold Exchange Traded Fund (HDFCMFGETF)

- Nippon India ETF Gold BeES (GOLDBEES)

- SBI Gold Exchange Traded Scheme (SBIGETS)

Gold Mutual Funds

Gold mutual funds hold baskets of assets which may include gold bullion, stocks of gold miners, and related interests.

Some of the best-performing gold mutual funds in the US are:

- Fidelity Select Gold Portfolio (FGDAX)

- First Eagle Gold Fund (SGGDX)

- Sprott Gold Equity Fund (SGDLX)

- Wells Fargo Precious Metals Fund (EKWAX)

Indian investors can consider the following gold Mutual Funds:

- Kotak Gold Fund

- SBI Gold Fund

- ICICI Prudential Regular Gold Savings Fund (FOF)

- Aditya Birla Sun Life Gold Fund

Gold Mining Stocks

Another way to gain exposure to the gold market is to invest in the companies that mine gold.

Ideally, when the cost of gold goes up, the value of those companies will similarly rise. However, mining company stocks do not always track with the price of gold.

In addition, these companies may be impacted by factors that are unlikely to impact the cost of gold, such as acquisition, political unrest, and ecological disasters.

Some of the best-known gold mining stocks include Barrick Gold Corp (GOLD) and Franco-Nevada (FNV).

It’s also possible to invest in gold exploration ventures — such as Global X Gold Explorers (GOEX) — but these are considered riskier.

Unfortunately, India does not have significant gold reserves and has to import most of the gold it needs. There is only one listed gold mining company in India- Deccan Gold.

Indian investors can anyways buy stocks of American gold mining companies by opening an overseas trading account.

Final Thoughts on Investing in Gold

Gold is arguably the most loved precious metal. It has proven its might over and over again throughout history. Unlike fiat currency (banknotes), it is limited in amount since it cannot be printed by central banks which makes it a suitable hedge against inflation.

Like any investment, there are pros and cons to investing in gold. Although it may not suit the needs of all, it is wise to have some Gold in your portfolio. It can help you when all other assets cry for help.

Take the time to learn about the market and consider your investment goals before diving in. Your knowledge will surely benefit you in many ways.

This article is the result of a collaboration between commodity.com and moneyhandle.in.

Nice..