Capital gains tax is a very confusing concept for beginners. Today let us make this crystal clear for you. Whenever you sell an asset such as stocks, mutual funds, bonds, debentures, real estate, etc., the profit you make from this transaction is called a capital gain.

Similarly, if you sell at a loss, you have a capital loss.

This is a simple concept which everyone can understand easily. But do you know that when you make any capital gain(profit) from a transaction, the government will take a part of that profit from you?

Well, don’t be surprised my friend, slowly you will realize that only two things are certain in life: Death and the other is, yes you guessed it right: taxes.

Capital gains taxes in India are not a straightforward uniform tax that is the same for every transaction/asset class. For example, the capital gain tax on stocks/mutual funds is different from the capital gain tax on gold and real estate.

Further, if you sell your asset within a short time, you may have to pay more taxes than what you would have to pay if you sold after a longer duration. In this post, I will try to simplify many such confusing aspects of capital gains taxes in India.

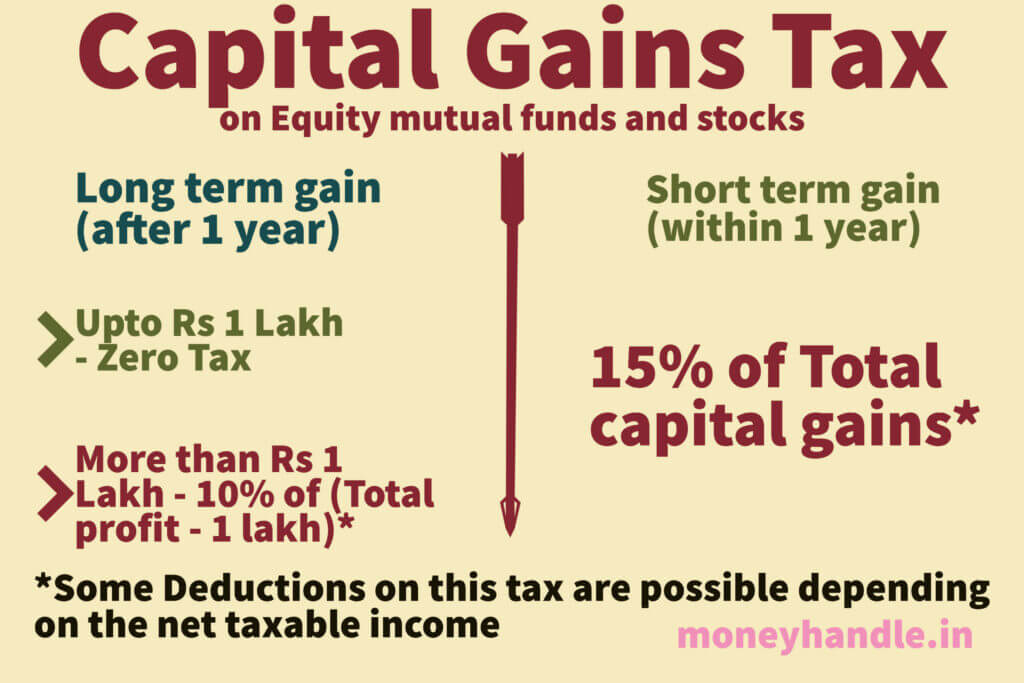

Q1. How much capital gains tax do I have to pay if I sell my equity Mutual funds and Stocks?

You have to pay capital gain tax to the government if you make a profit from the sale of shares or equity mutual funds. The tax amount will depend on the period of time you hold these funds. For example, if you sell your shares within 1 year of the purchase date, you will have to pay a Short-term capital gain tax(STCG) of 15% on the profit.

However, if you sell your shares anytime after 1 year of the purchase date, the tax you need to pay will depend on the profit you make. This is called Long-term capital gain tax(LTCG)

Case 1: If the profit you make from selling your shares/mutual funds is less than Rs. 1 Lakh, you do not need to pay any tax whatsoever. Hence LTCG for a capital gain of less than 1 Lakh is zero.

Case 2: If the profit you make is more than Rs. 1 Lakh, then you need to pay LTCG of 10% on the profit above 1 Lakh. For example, your total capital gain for the year is Rs. 1 lakh 50 thousand, then you will pay 10% of 50 thousand which is equal to 5 thousand rupees. ((1,50,000 – 50,000)*10)/100 = 5000. Similarly, if your capital gain for the year is 2 lakhs, you will pay 10% on 1 lakh rupees that is 10 thousand.

Q2. How much capital gain tax do I have to pay if I sell my debt investments such as debt Mutual funds and bonds?

Profits from Debt mutual funds, bonds, gold, jewelry, and government securities are taxed differently from equity counterparts. In the case of debt instruments, the short term is defined as 3 years, unlike equity where it is 1 year. Therefore, if you sell your debt mutual funds etc. within 3 years of purchase, the entire capital gains will be added to your regular income and taxed at the tax slab you fall into.

However, if you sell them after 3 years, the government will consider them as long term capital gains and tax them at 20%. However, there is a relief for these investments as the seller gets the benefit of indexation which reduces the tax liability sufficiently to lower the tax burden. We will try to understand about indexation a bit later.

Q3. How are Intraday trading gains taxed?

Intraday trading of shares is a speculative transaction according to the Income Tax Act. If you make a profit from intraday trading, i.e. buying and selling shares on the same day, the profit is not considered as short term capital gain but is treated as speculative business income. Section 43(5) of The Income Tax Act defines the term Speculative transaction.

Hence, while filing your ITR, you need to mention the profits from the Intraday transaction under business income.

Q4. Is there any capital gains tax on the dividends?

There is a tax on dividend income but we don’t consider it as a Capital gain tax because there is no selling involved. There is a tax on virtually every transaction you make and dividends are no exception.

In the earlier system before April 2020, the companies deducted 15% Dividend distribution tax (DDT) from the total dividend, and the remaining 85% was distributed among the shareholders. Shareholders did not pay any tax on the dividend income then.

Now the system has been tweaked and the Dividend distribution tax is abolished. Now whatever dividend income you will get, you have to add it to your total income and it will be taxed accordingly. Additionally, if the total annual dividend you get is more than Rs 5 thousand, the company will deduct 10% TDS before giving you the dividend.

Q5. Does the government give me money if I make a loss on the sale of my investments?

Amateur investors ask this innocent question but I think you already know the answer. No one will pay you anything if you make a loss. If the government starts compensating investors for capital losses, it will go bankrupt in a matter of days 🙂

But the government has given some relief to investors by allowing them to pay the capital gains tax on only the net profit which is the total profit minus total loss.

- Is SIP better than lumpsum investments in Mutual Funds?

- What is Muhurat Trading and is it really lucky?

Suppose I make 50 thousand profit in a year by selling my Infosys shares and 40 thousand loss by selling SBI shares, then my net taxable capital gain is only 10 thousand rupees. Again, if this is realized within a year, then STCG of 15% will apply on Rs 10 thousand. In case this profit/loss was from the sale of shares held for more than 1 year, there will be no tax on this profit since it is less than 1 lakh.

Q6. What happens if I make a net loss?

If your total profits are less than your total losses, then you have a net loss. In this case, you do not need to pay any taxes. Moreover, you can even carry forward your losses to the subsequent years. Let us understand with an example:

Suppose I have 100 shares of SBI which I sell at a profit of Rs 10 thousand total. and 100 shares of IRCTC which I sell at a loss of 20 thousand. Now my total loss is Rs 10 thousand for the financial year. Therefore I need not pay any capital gains tax this year and also if I show this loss while filing my income tax returns, then I will get benefits in the following way.

Suppose in the next year I make a total profit of Rs 10 thousand and my carried forward loss from last year is also 10 thousand, then the net profit for this year will come out to be zero and I will not pay any tax this year. Hope this makes sense now.

Q7. What is benefit of Indexation?

Inflation, or the reduction in the purchasing power of the rupee over the years and is a silent killer of returns for any investment. Put simple, today milk is sold at Rs 54/liter but it was sold at Rs 15/liter in 2006. We need more money to buy same quantity of the same item therefore the currency has become weaker or lost its value.

Suppose the annual average rate of inflation is 5%. If the bank FD provides you 5.5% annual return then in reality, your money grows by only 0.5% annually. Thus, inflation silently eats away your returns. To protect investors from the effects of inflation, indexation benefit has been introduced.

The benefit of Indexation is available only to a selected class of assets such as real estate, debt mutual funds, and bonds, etc.

How Indexation works?

We will not go into the details of indexation here but lt us briefly see how it helps the investors.

Suppose you had bought a piece of land in 2006 for Rs 5 lakhs. Now in 2021, you want to sell it for Rs 20 lakhs. If there was no indexation benefit, your tax liability on this transaction would have been 20% of the profit plus 4% cess on the tax, i.e. 20% of Rs 15 lakhs which is Rs 3 lakhs. and 4% of 3 lakhs would be Rs 12 thousand. Therefore total tax would be Rs 3 lakhs 12 thousand which is a lot of money.

But this is not the case. Taking the benefit of indexation, the cost price you will consider for calculating the profit will not be 5 lakh now. Instead, we calculate the present value of the initial investment using the Cost Inflation index which essentially is the inflation over the years. The CII is notified by the government for each year.

Calculating the present value of an old asset using Indexation

To calculate the present value of the original investment, we do as follows:

Present value = (CII value in the financial year of sale / CII value in the financial year of purchase) X Original value.

Here, CII in 2005-06 = 117 and CII in 2020-21 =311

Hence Present value = (301/117) * 5 lakhs = Rs. 12 lakh 86 thousand

Now to calculate the capital gains, we subtract the calculated present value from the selling price which comes out to be Rs 7 lakh and 14 thousand only instead of the earlier 15 lakh without applying indexation. The tax is Rs 1 lakh and 48 thousand rupees approximately in this case.

Thus with the benefit of indexation, we were able to save almost 50% tax which would have been impossible otherwise.

The key thing to note here is that the benefit of indexation is only available on long term transaction (>3 years). Moreover, long-term capital gains from stock market transactions are not provided the benefit of indexation.

Calculating Income tax on capital gains

On the website of the Income-tax department, there is a tool for calculating your tax liability. You can use this for free by clicking here. However, if you are a complete beginner, the tool can be confusing.

Conclusion

Understanding and Calculating capital gain taxes is a confusing process. Due to so many clauses and conditions involving holding time, type of asset, etc., the topic becomes fearsome but if you are doing transactions in the stock markets, you should know about the tax implications clearly or you could land in trouble. Even if you don’t pay taxes and don’t get caught, it is good to know how much you owe. In any case, I hope this helped you in some way or the other.

If you have any questions, please write them below in the comments and I will try to answer them for you very soon. Thanks for reading.