Starting your investment journey can be daunting in the current scenario when we have more than 2500 mutual funds available in India. Nearly every mutual fund advisor will tell you to start a SIP in some mutual fund s/he is selling. Systematic investment planning is undoubtedly a great proposition for investors but the question is: Is Investing via SIP better than lumpsum investments in mutual funds? Should you put 5000 each month or 5 lakhs in one go?

Why not put all your money all at once instead of slowly investing fixed sums of money at regular intervals through a Systematic investment plan or SIP? I will try to share my perspective on this topic today after doing some research and practically experiencing the markets through the last few roller-coaster years.

New to the stock markets? Read The stock market vocabulary: 20 common terms for beginners

Large Institutional investors vs the Average investor

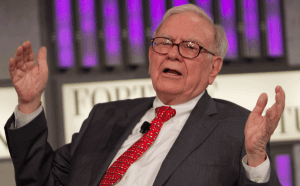

When I started my investing journey, I used to read a lot of books, blogs, and news articles. Everybody praised SIP but I thought that if SIP is so good, why don’t the top investors of the world such as Warren Buffet invest via the SIP route? Wouldn’t it make his life a hell lot easier if he just put his investments on autopilot?

I found that I was stupid to think like this when I dug deeper. Firstly, it is a sin to compare Warren Buffet with a normal individual investor. Mr. Buffet is a professional full-time “value” investor who manages a multi-billion dollar portfolio. A value investor looks for bargains in the stock market. It is against the principles of value investing to buy a stock when it is selling expensive as compared to its intrinsic value. Large investors can better time the markets than us normal folks as they have greater insider knowledge, resources and insights. It should not be surprising if they also have knowledge of confidential government decisions. Hence, they are in a better position to time the market and adjust their portfolios accordingly.

With SIP, you do not care whether the underlying portfolio of stocks in the mutual fund is overvalued or undervalued. A value investor would avoid buying in overvalued markets.

Timing and valuations

Arriving at underlying valuation of a company

So how do you find out whether a stock is undervalued (when intrinsic value is more than the market price)? Valuation is an extensive field of study and people spend a lot of time learning the art of valuation. I am still learning and may not guide you very well here but if you still insist, I can tell you is that basic valuation starts at understanding the PE ratio, Discounted cash flow technique (DCF), and so on. Arriving at a very accurate intrinsic value of a company is a hard thing to do. Even Successful investors make mistakes. But a man called Aswath Damodaran, who is a professor of corporate finance and valuations at the New York University can help you learn this art. You may check out his lectures on youtube.

Successful large investment advisory companies such as Ray Dalio‘s Bridgewater Associates hire top-class research analysts to study companies. They have built complex data models and computer programs to test their strategies. Professional fund managers spend large sums of money to do extensive research and then put their clients’ put money into a particular instrument. They make very calculated bets and produce a stellar outcome.

A small individual investor does not have either the capacity or the time to do such research and most of their decisions are based on few facts and largely their emotions and biases about the particular stock. This is why most people lose money in the markets.

Timing the stock market

Timing the stock market is a tricky business and even seasoned investors usually don’t get it right. By timing, I mean predicting the right time to enter and exit the market. It is impossible to say what will happen tomorrow. You can be sure that the markets are overvalued or undervalued but you cannot predict for how long they will stay in that shape.

But I am not saying that the individual investor should give up. If you are devoted to this field and can invest your time in doing the necessary research, sky is the limit. That’s why this is such a beautiful and exciting subject and many small investors have made fortunes from the markets.

Are you an Active investor or a passive investor?

Let’s face the reality, and question ourselves if our interest truly lies in this field and can we invest the time required to do the necessary research? If you are doubtful, you can go with SIPs without any fear. Although SIP is not the perfect investment strategy, it is good enough and can give you better results than most other folks around you. Let me explain why I am saying that.

Last year in March after the lockdowns, Nifty crashed to about 7500. Most people sold their holding at that time. Many even cashed out their mutual funds. Everyone knows of the rally that followed in the subsequent months. People who continued their SIPs during that time made a very good return.

Lumpsum investments made in March last year would obviously have made a much better return than your SIP. But at that time, no one knew that it was the bottom and things always look easy in the hindsight. I invested a lump sum amount during that time but the amount was not as large as it should have been. I too was influenced by the negativity prevailing at that time. Last year taught me more than ever and made me more humble and I have started to appreciate SIPs more.

My choice: SIP or Lumpsum?

My personal choice is a modest amount invested through SIP and investing large sums when markets are cheap. There is no one perfect strategy in investing but as with most things in life, striking a good balance between the various options is the key to a successful and happy investing journey. So if you now ask me again if SIP is better than lumpsum investments in mutual funds, I will say that in some ways, SIPs are better, and in others, lump-sum beats SIPs.

SIP provides a disciplined way of investing which eliminates the need to time the market, which is a difficult thing. I think every individual should do investing via the SIP route. Even active investors should do SIPs because everyone is wrong sometimes. SIP makes your journey less bumpy.

Discipline is the bridge between goals and accomplishment.

Jim Rohn

There is always the option of lump-sum investments open to you. If you believe that the markets are grossly undervalued and in panic mode, invest lump sums during those times. But also let the SIP do its job. Many times we keep waiting for the markets to correct so that we would invest huge sums at one go. But evidence suggests that people who kept waiting for the “right time” were left behind those who were consistent with their investments at all times.

Closing thoughts

In stock markets, it is more important to know what not to do because your hard-earned money is at stake. That’s why I wrote an article that can help you evaluate a company quickly using 6 super important financial ratios. I will urge you to read it as it will help you to filter out the financially sick or overvalued companies.

I am sure that now you have some clarity on this convoluted topic of SIP vs lump sum. You can disagree with me if you want. I’d love to discuss more on this so don’t hesitate from posting comments below. If you liked this post, please share it with your friends using the social media buttons below. Till then, keep reading, and happy investing!

Very informative

Great Article.

thanks Tript. Keep reading 😊