Have you asked yourself, “How much time should I spend researching a company before I invest in it?” Well, chances are you haven’t. The best mutual fund manager of all times, Peter Lynch says that people do more research before buying a refrigerator than they do before buying a stock. Perhaps this is the reason why every other person seems to have burnt their fingers in the stock markets. To help you prevent the mistakes people make while buying stocks, here are six necessary health checks for a company before investing your money into it.

If you are putting money into a company without reading its annual report and balance sheet of the past few years, I’m sorry but you are committing a crime. No successful investor ever made money from companies with weak fundamentals. I’m not talking about traders who buy and sell the same day or the same week. If you want to make any substantial money from the markets, assessing the health of the company’s finances is of prime importance. You absolutely do not want to buy a company with a huge debt and insufficient cash and other assets to pay off that loan.

Let us discuss six basic checks you must perform before buying the stock of any company. These checks will help you understand the current health of the company. They will also help you in understanding if this is the correct time to buy or not. By no means however is this list exhaustive and there are several other things to factor in before making any decision.

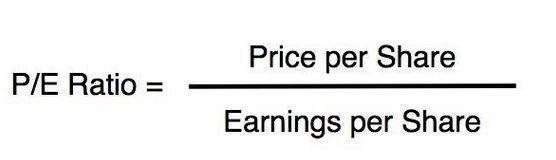

1. What’s the PE?

Will you buy a Honda Activa scooter for Rs 2 lacs? Of course not because you know it is overpriced. But how do you know if a share is overpriced? A 5 rupee share may be more expensive than a 2000 rupee share although it appears just the opposite. PE is a simple financial ratio used in

PE or the Price to earnings ratio is a number obtained by dividing the price of one share of the company by the earnings per share(EPS). However, you do not have to calculate it. It is easily available on the internet on sites like moneycontrol.com. PE can tell you if the share is selling at a cheap, expensive or a justifiable price.

Peter Lynch explains PE as the number of years it will take for the company to earn the money you invested in it provided the earnings remain constant. It means that higher the PE, more the time required for your money to grow and therefore a high PE ratio is considered bad even if the company is excellent. Just look at the PE of the company you are analyzing and see if it is too high. Now you may be wondering how high is too high? While there is no formal definition, but a PE of 25 and above is considered high enough to be wary. Stocks of different categories have different PEs. A high growth company may have a higher PE than a slow-growing company. Therefore, IT companies in India usually have higher PEs than mining companies.

How high is high

Usually, high PEs reflect the high expectations of investors who believe that the company will earn lots of profits in the future. If the company with a high PE does not earn enough, in line with the expectations of the investors, the stock price usually tumbles down. Therefore do not invest when the PE is unreasonably high (Do not buy if PE is more than 30 no matter how good the company is). Look for PEs below 20, the lower the better if everything else is fine. Further, you must look at the last 5 years PE for a clearer picture. It will then start making sense when you see the price trends along with PE. You may notice that when PE was too high and earnings did not come, the price fell down and vice versa.

2. How’s the Debt?

Recently a lot of companies in India have been in news for one thing: High Debt. Companies usually depend on borrowed money for a number of things from expansion to advertising to research. Things start getting dirty when they are unable to pay back. When any such news comes out, the stock price usually goes down. Look at what happened to Kingfisher, Jet Airways, DHFL, etc.

There are three basic tests to know the debt situation of an organization.

i. The debt to equity ratio:

The debt to equity ratio is a critical tool for analyzing the debt burden of the company. This ratio must be less than 1. A DE ratio more than 1 signifies that the company has taken more debt than the total equity (investors money). This is a dangerous situation. Avoid companies with Debt to equity more than 1. Good businesses do not accumulate huge debt and the DE for such good companies are below 0.5.

ii. Current Ratio:

Current ratio is obtained by dividing the current assets by current liabilities listed on the company’s balance sheet. The term ‘current’ signifies ‘short-term’ or ‘within 1 year’. The current ratio tells us if the company is able to repay its short term loans back. If the current ratio is more than 1, it is a good sign. Avoid companies with current ratios less than 1.

iii. The interest coverage ratio

To know if the company is earning enough to pay interest on the loans, we use the interest coverage ratio. It tells you how able the company is in repaying the interest. Although the higher the better, but just make sure this number is at least 1.5 or be prepared to land into trouble.

3. What is the return on equity?

To understand the return on equity, we have to know what is equity capital. Companies need money to grow business. They have 2 choices if they cannot afford the cost themselves. They can take a loan from banks and pay interest or, they can borrow money from investors in return of equity shares. This money borrowed from investors is called the shareholder’s fund or equity capital. Therefore, the total capital a company borrows is the sum of debt capital (from banks) and equity capital (from shareholders). Usually, companies try to avoid bank loans due to large interest costs and strict laws requiring companies to pay back on time.

Return on equity is a percentage which tells you what part of the equity capital (Shareholder’s funds) the company has been able to earn back in a year. It is an essential health check for a company.

Return on Equity(ROE) = (Net Income/Equity capital) x 100 = (150/1000) x100 = 15%

RoE is an essential measure of the company’s ability to earn money for the shareholders as it gauges the earning potential. The thing to look while analyzing RoE is whether it is above 10% or not. Moreover, the investor must look not only at the last year’s RoE but at least for the 5 previous years if not more. A healthy return on equity of 15 percent or more is a good sign one must look for. If the RoE is less than 10%, caution is advised. Do more in-depth analysis in such cases and invest only if strong signs of a turnaround are evident.

You may also Like:

A Beginner’s Guide to penny stocks Nifty Next 50 as an Investment Option: Composition, 22-year Returns, Index funds, and ETFs

4. What is the Return on Capital Employed?

Return on capital employed or RoCE takes into account the total capital (i.e. the bank loan as well as the equity capital) for calculating

Let’s say company z has debt capital(loans) worth Rs 1000 crores and shareholder’s equity capital of Rs 1000 crore. The interest rate on

RoCE = (Net Income/Total Capital) x 100 = {200/(1000+1000)} x 100 = 10%

Interest on loan = 10% of 1000 crore = Rs 100 crore.

From the above illustration, we see that the return on capital employed is 10%, i.e.200 crore, half of which will be used up for paying interest. Similar to RoE, RoCE for at least trailing 5 years must be taken into consideration while analyzing a company’s performance. You do not have to manually calculate the RoCE each time as it is easily available on the internet.

TIP: RoCE is considered more important while studying companies in the Manufacturing sector as they require more capital for operations than others.

5. How much is the Promoters holding and has it changed?

Promoters, as the name suggests, are people responsible for promoting the company. They can be individuals (eg. CEO, Co-founder, etc.) or a group holding a large percentage of shares in a company. For instance, the Tata group is the promoter of TCS, Tata Motors, etc. Promoters have a say in all the decisions a company makes. Promoters take care of the welfare of the company. Promoter holding is the percentage of shares lying with the promoter.

Promoter holding is easily available for companies listed on Indian stock exchanges. What one should look for is that the promoter holding should be a significant figure and that there has not been a decrease in promoter holding in recent years. If there has been a decline, try to find out the reason. The stock market considers a decrease in the shareholding of promoters as a negative sign. If the promoter’s stake has increased, it is a good indicator and signifies increased trust in the company’s future.

6. Earnings per share

Earnings per share or EPS is a good performance indicator which simply tells how much has each share has earned for the investor. Growth in EPS in the last few consecutive quarters can be a sign of growth and may present an opportunity to invest. EPS is also used while calculating

A word of caution

The mathematical ratios listed above are excellent indicators of a company’s health. If you look at these faithfully before investing, the rewards will follow. But there is a catch. Never depend entirely on mathematical ratios for buying a company. There are several other factors affecting the future prospects of a company’s growth such as competition, government policies, quality and integrity of management,

Conclusion

The 6 health checks for a company listed above are essential but before making any buying decision, a holistic approach is required. An unbiased view is of utmost importance in one’s investing journey. Further, even if you have found a rare gem at a good price, it is never advisable to put all your money into it. As Warren Buffet says, Never test the depth of the water with both your feet. Even the greatest investors have made mistakes and you and I are not even close to them hence control over emotions is strictly required.

I will right away clutch your rss feed as I can not in finding your e-mail subscription link or e-newsletter service. Do you’ve any? Please let me realize in order that I may subscribe. Thanks.

Amol Agarwal

thanks for sharing the various 6 health check factors of the company.

Thanks Rocky! glad that you liked this post. These 6 essential checks will save you from bad companies.

Nice..

Keep us posted..